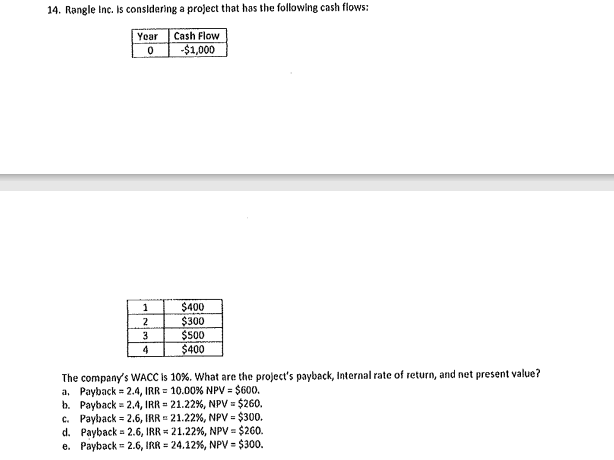

Question: 14. Rangle Inc. is considering a project that has the following cash flows: The company's WACC is 10%. What are the project's payback, internal rate

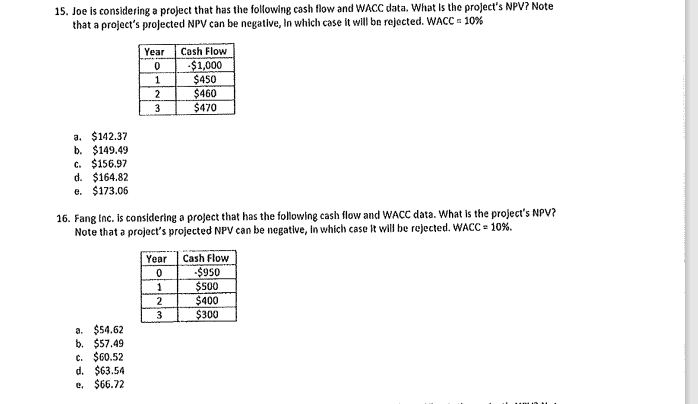

14. Rangle Inc. is considering a project that has the following cash flows: The company's WACC is 10%. What are the project's payback, internal rate of return, and net present value? a. Payback =2.4, IRR =10.00%NPV=$600. b. P ayback =2,4,IRR=21.22%,NPV=$260. c. Payback =2.6, IRR =21.22%,NPV=$300. d. Payback =2.6,IRR=21,22%,NPV=$260. e. Payback =2.6,IRR=24.12%,NPV=$300. 15. Joe is considering a project that has the following cash flow and WACC data. What is the project's NPV? Note that a project's projected NPV can be negative, In which case it will be rejected. WACC =10% a. $142.37 b. $149.49 c. $156.97 d. $164.82 e. $173.06 16. Fang inc. is considering a project that has the following cash flow and WACC data. What is the project's NPV? Note that a project's projected NPV can be negative, in which case it will be rejected. WACC =10%. a. $54,62 b. $57,49 c. $60.52 d. $63.5A e, $66.72

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts