Question: 14) The only difference between variable and absorption costing is the expensing of A) direct manufacturing costs B) variable marketing costs C) fixed manufacturing costs

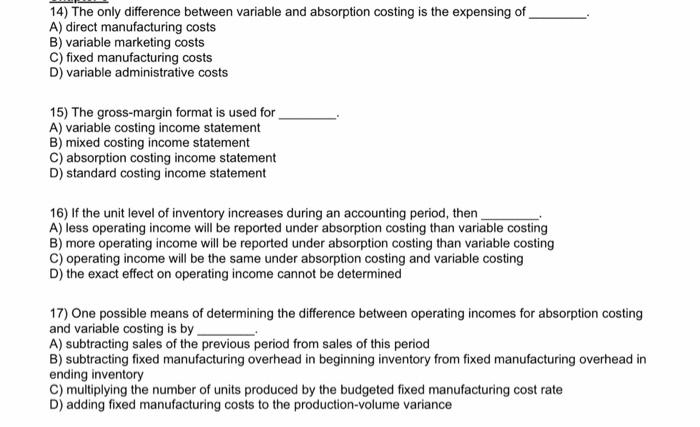

14) The only difference between variable and absorption costing is the expensing of A) direct manufacturing costs B) variable marketing costs C) fixed manufacturing costs D) variable administrative costs 15) The gross-margin format is used for A) variable costing income statement B) mixed costing income statement C) absorption costing income statement D) standard costing income statement 16) If the unit level of inventory increases during an accounting period, then A) less operating income will be reported under absorption costing than variable costing B) more operating income will be reported under absorption costing than variable costing C) operating income will be the same under absorption costing and variable costing D) the exact effect on operating income cannot be determined 17) One possible means of determining the difference between operating incomes for absorption costing and variable costing is by A) subtracting sales of the previous period from sales of this period B) subtracting fixed manufacturing overhead in beginning inventory from fixed manufacturing overhead in ending inventory C) multiplying the number of units produced by the budgeted fixed manufacturing cost rate D) adding fixed manufacturing costs to the production-volume variance

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts