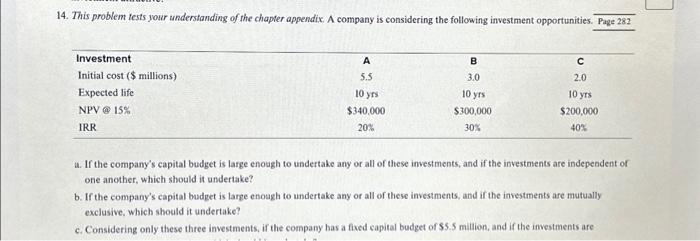

Question: 14. This problem tests your understanding of the chapter appendix. A company is considering the following investment opportunities. Page 282 Investment Initial cost ($ millions)

14. This problem lests your understanding of the chapter appendix. A company is considering the following investment opportunities. Page 282 u. If the company's capital budget is large enough to undertake any of all of these imvestments, and if the investments are independent of one another, which should it undertake? b. If the company's capital budget is large enough to undertake any or all of these investments, and if the investments are mutually exclusive; which should it undertake? c. Considering only these three investments, if the company has a fived capital budget of $5.5 million, and if the imvestments are 14. This problem lests your understanding of the chapter appendix. A company is considering the following investment opportunities. Page 282 u. If the company's capital budget is large enough to undertake any of all of these imvestments, and if the investments are independent of one another, which should it undertake? b. If the company's capital budget is large enough to undertake any or all of these investments, and if the investments are mutually exclusive; which should it undertake? c. Considering only these three investments, if the company has a fived capital budget of $5.5 million, and if the imvestments are

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts