Question: 14 TO PE-2A. PLEASE ANSWER E2-14 Selected transactions for Bonnie Donne Company during its first month in business are presented below. a. Journalize the transactions

14 TO PE-2A. PLEASE ANSWER

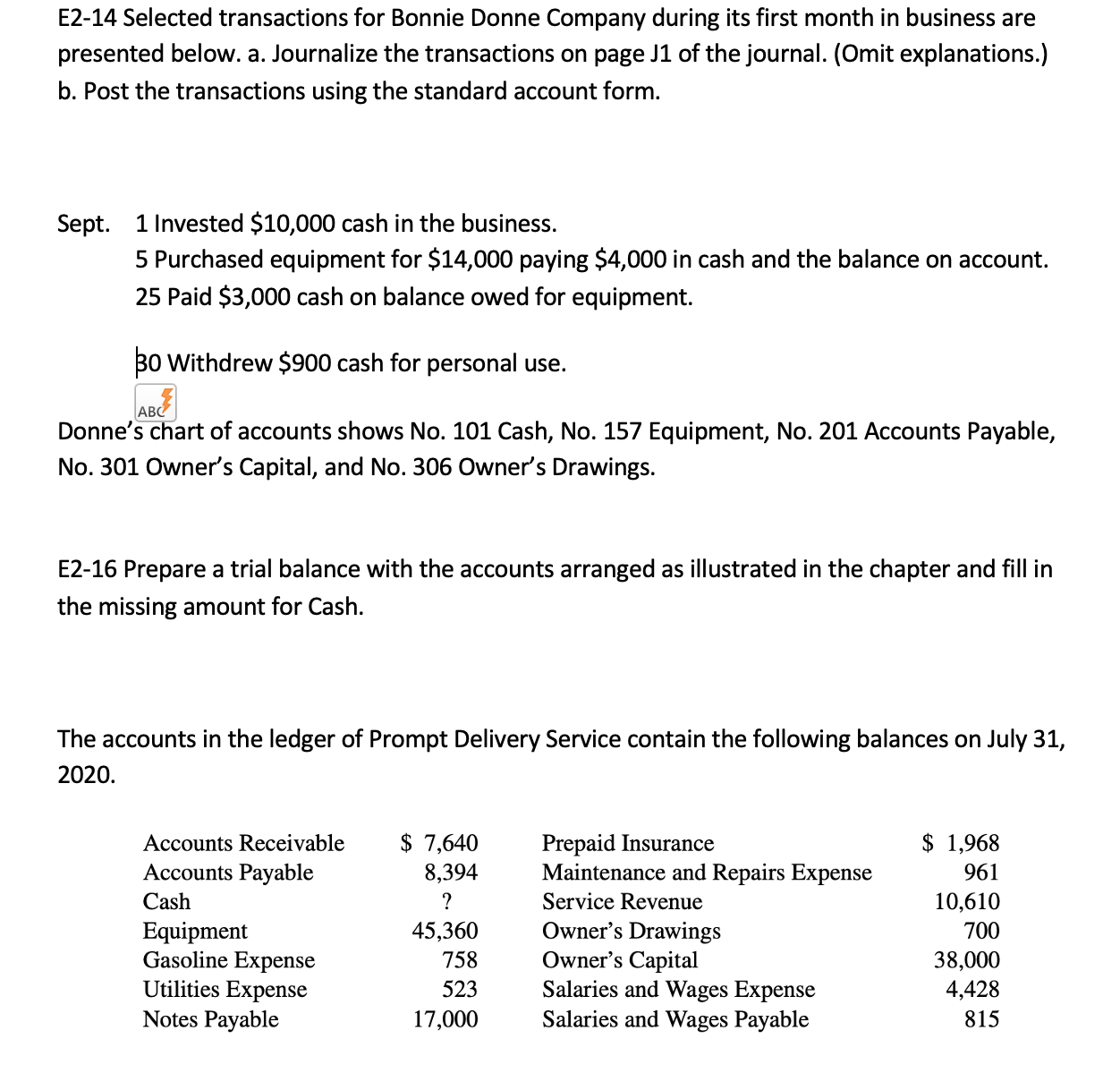

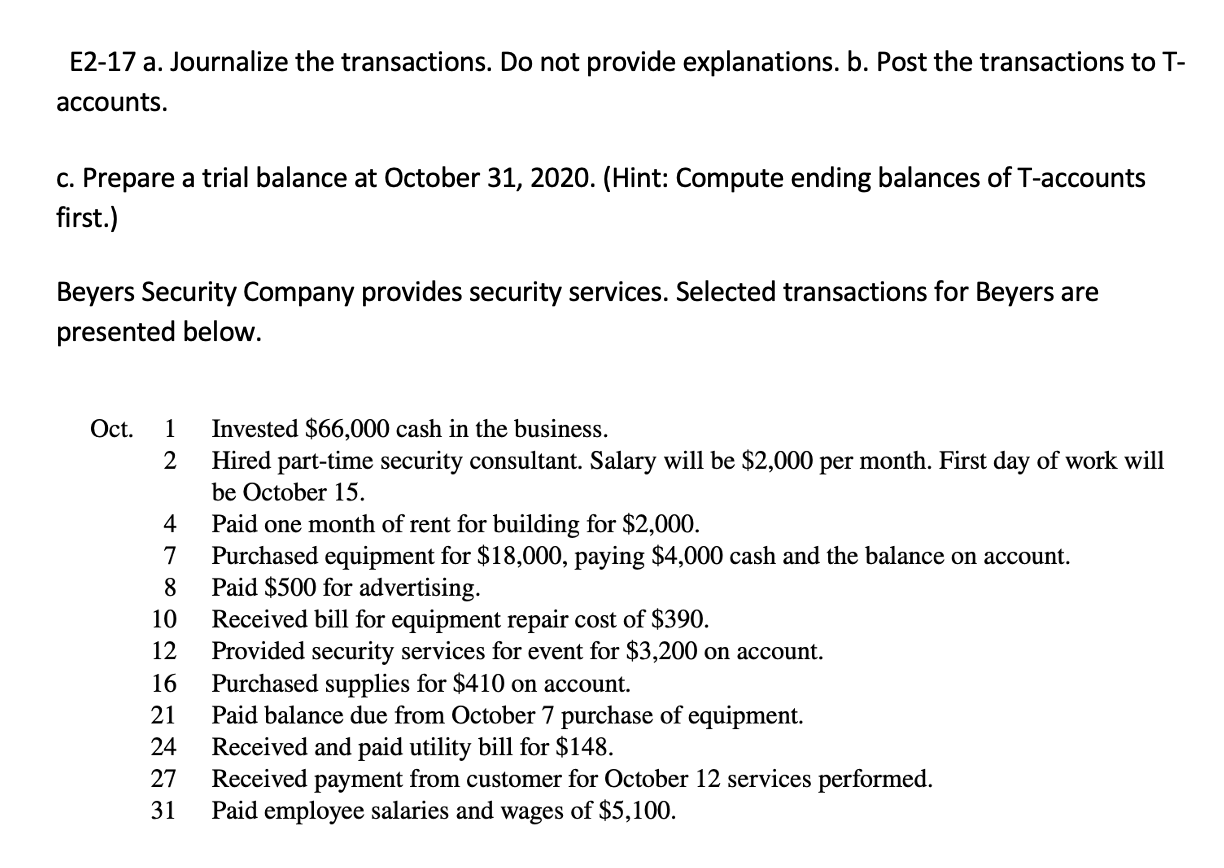

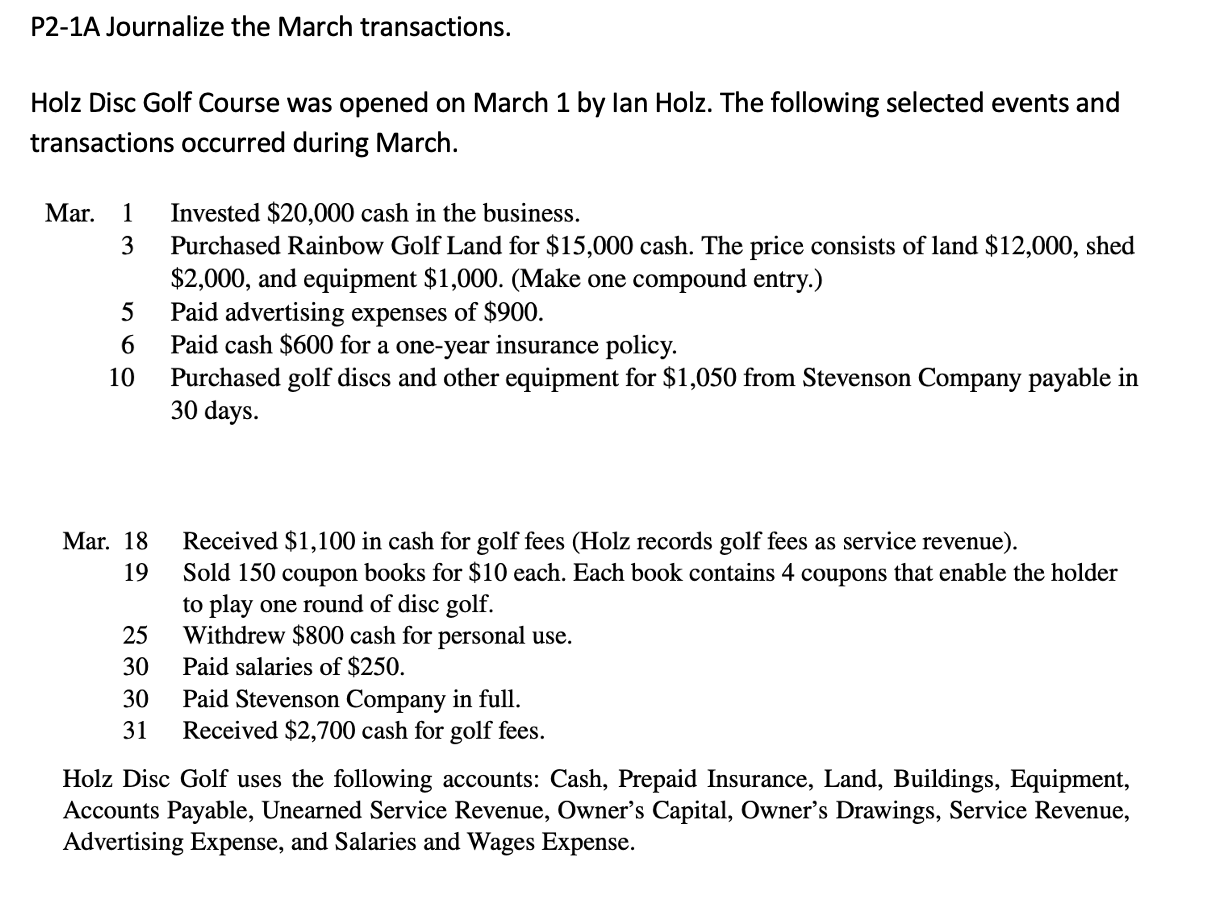

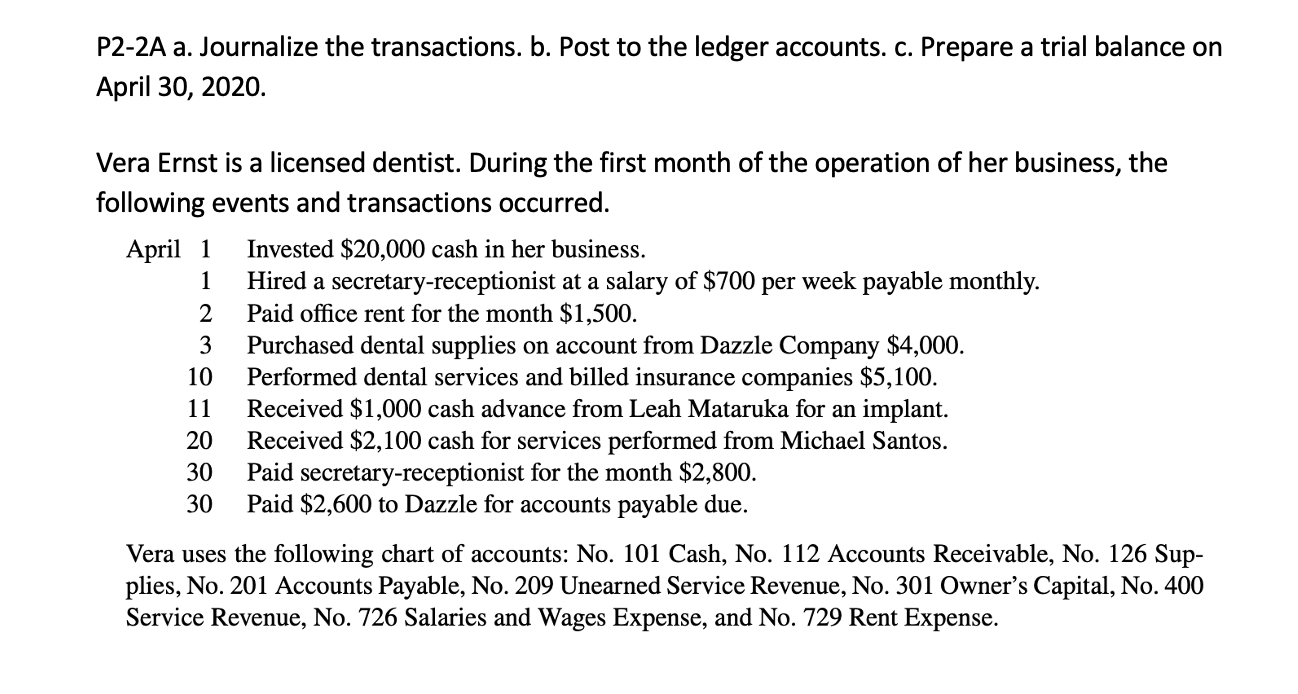

E2-14 Selected transactions for Bonnie Donne Company during its first month in business are presented below. a. Journalize the transactions on page J1 of the journal. (Omit explanations.) b. Post the transactions using the standard account form. Sept. 1 Invested $10,000 cash in the business. 5 Purchased equipment for $14,000 paying $4,000 in cash and the balance on account. 25 Paid $3,000 cash on balance owed for equipment. I30 Withdrew $900 cash for personal use. Donne's c art of accounts shows No. 101 Cash, No. 157 Equipment, No. 201 Accounts Payable, No. 301 Owner's Capital, and No. 306 Ownel's Drawings. E2-16 Prepare a trial balance with the accounts arranged as illustrated in the chapter and ll in the missing amount for Cash. The accounts in the ledger of Prompt Delivery Service contain the following balances on July 31, 2020. Accounts Receivable $ 7,640 Prepaid Insurance 35 1,968 Accounts Payable 8,394 Maintenance and Repairs Expense 961 Cash ? Service Revenue 10,610 Equipment 45,360 Owner's Drawings 700 Gasoline Expense 758 Owner's Capital 33,000 Utilities Expense 523 Salaries and Wages Expense 4,428 Notes Payable 17,000 Salaries and Wages Payable 815 E2-17 a. Journalize the transactions. Do not provide explanations. b. Post the transactions to T- accounts. c. Prepare a trial balance at October 31, 2020. (Hint: Compute ending balances of T-accounts rst.) Beyers Security Company provides security services. Selected transactions for Beyers are presented below. Oct. 1 Invested $66,000 cash in the business. Hired part-time security consultant. Salary will be $2,000 per month. First day of work will be October 15. 4 Paid one month of rent for building for $2,000. 7 Purchased equipment for $18,000, paying $4,000 cash and the balance on account. 8 Paid $500 for advertising. 10 Received bill for equipment repair cost of $390. 12 Provided security services for event for $3,200 on account. 16 Purchased supplies for $410 on account. 21 Paid balance due from October 7 purchase of equipment. 24 Received and paid utility bill for $148. 27 Received payment from customer for October 12 services performed. 31 Paid employee salaries and wages of $5,100. P2-1A Journalize the March transactions. Holz Disc Golf Course was opened on March 1 by Ian Holz. The following selected events and transactions occurred during March. Mar. 1 3 U] Mar. 18 19 25 30 30 31 Invested $20,000 cash in the business. Purchased Rainbow Golf Land for $15,000 cash. The price consists of land $12,000, shed $2,000, and equipment $1,000. (Make one compound entry.) Paid advertising expenses of $900. Paid cash $600 for a oneyear insurance policy. Purchased golf discs and other equipment for $1,050 from Stevenson Company payable in 30 days. Received $1,100 in cash for golf fees (Holz records golf fees as service revenue). Sold 150 coupon books for $10 each. Each book contains 4 coupons that enable the holder to play one round of disc golf. Withdrew $800 cash for personal use. Paid salaries of $250. Paid Stevenson Company in full. Received $2,700 cash for golf fees. Holz Disc Golf uses the following accounts: Cash, Prepaid Insurance, Land, Buildings, Equipment, Accounts Payable, Unearned Service Revenue, Owner's Capital, Owner's Drawings, Service Revenue, Advertising Expense, and Salaries and Wages Expense. P2-2A a. Journalize the transactions. b. Post to the ledger accounts. c. Prepare a trial balance on April 30, 2020. Vera Ernst is a licensed dentist. During the first month of the operation of her business, the following events and transactions occurred. April 1 Invested $20,000 cash in her business. 1 Hired a secretary-receptionist at a salary of $700 per week payable monthly. 2 Paid ofce rent for the month $1,500. 3 Purchased dental supplies on account from Dazzle Company $4,000. 10 Performed dental services and billed insurance companies $5,100. 11 Received $1,000 cash advance from Leah Mataruka for an implant. 20 Received $2,100 cash for services performed from Michael Santos. 30 Paid secretary-receptionist for the month $2,800. 30 Paid $2,600 to Dazzle for accounts payable due. Vera uses the following chart of accounts: No. 101 Cash, No. 112 Accounts Receivable, No. 126 Sup- plies, No. 201 Accounts Payable, No. 209 Unearned Service Revenue, No. 301 Owner's Capital, No. 400 Service Revenue, No. 726 Salaries and Wages Expense, and No. 729 Rent Expense