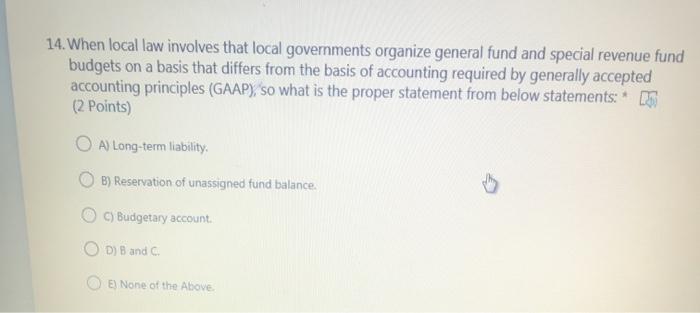

Question: 14. When local law involves that local governments organize general fund and special revenue fund budgets on a basis that differs from the basis of

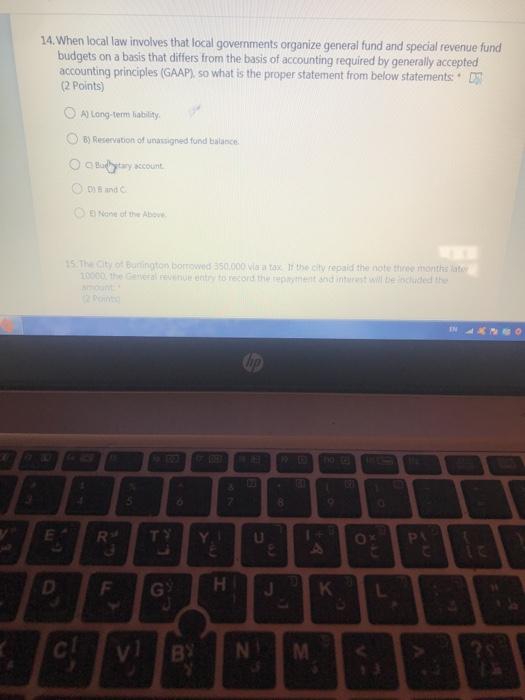

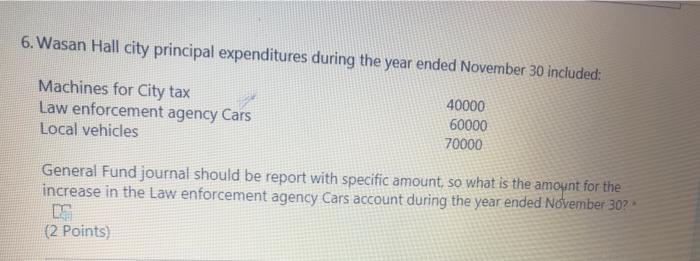

14. When local law involves that local governments organize general fund and special revenue fund budgets on a basis that differs from the basis of accounting required by generally accepted accounting principles (GAAP), so what is the proper statement from below statements: * (2 points) O A) Long-term liability B) Reservation of unassigned fund balance. C) Budgetary account OD) Band E) None of the Above 14. When local law involves that local governments organize general fund and special revenue fund budgets on a basis that differs from the basis of accounting required by generally accepted accounting principles (GAAP), so what is the proper statement from below statements 03 (2 points) A long-term liability B) Reservation of unassigned fund stanice Octywy account und None of the 15.Thay o bunington borrowed 350.000 Vax the city repaid the note the months late 6 R 3 T U PA D . K BY N. M 6. Wasan Hall city principal expenditures during the year ended November 30 included: Machines for City tax Law enforcement agency Cars Local vehicles 40000 60000 70000 General Fund journal should be report with specific amount, so what is the amount for the increase in the Law enforcement agency Cars account during the year ended November 30? (2 Points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts