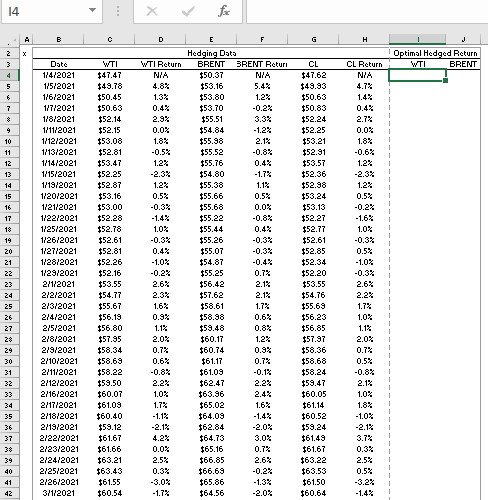

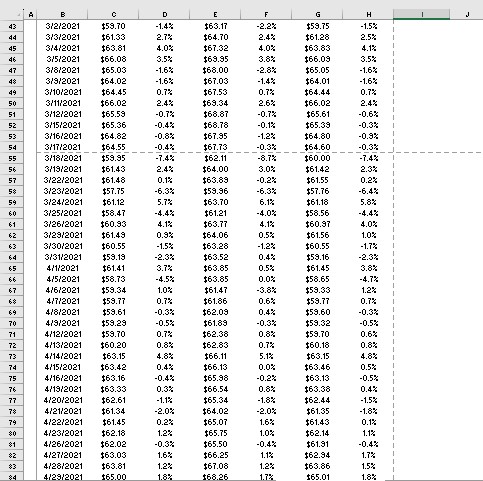

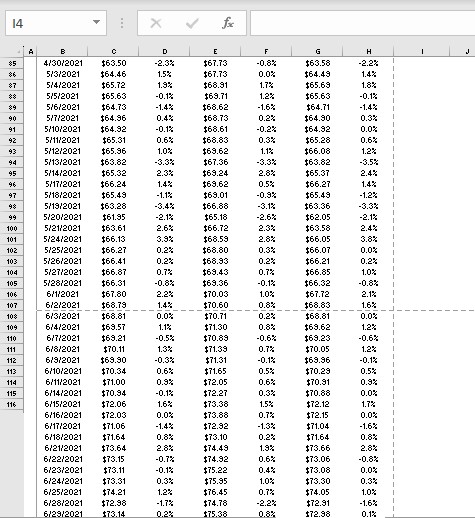

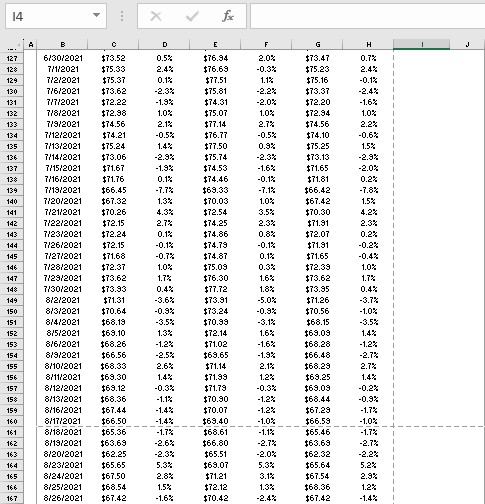

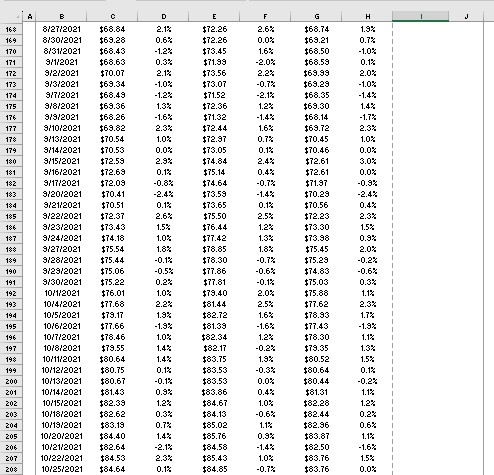

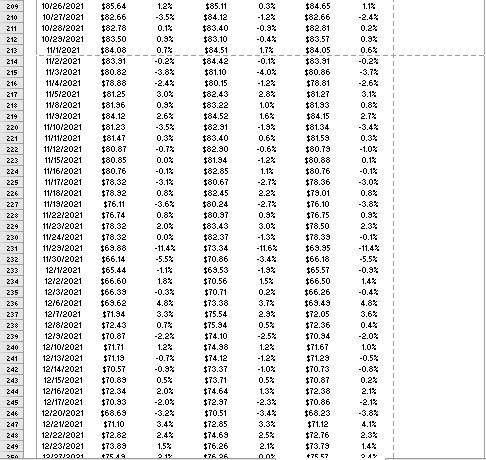

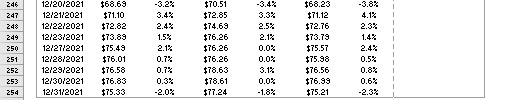

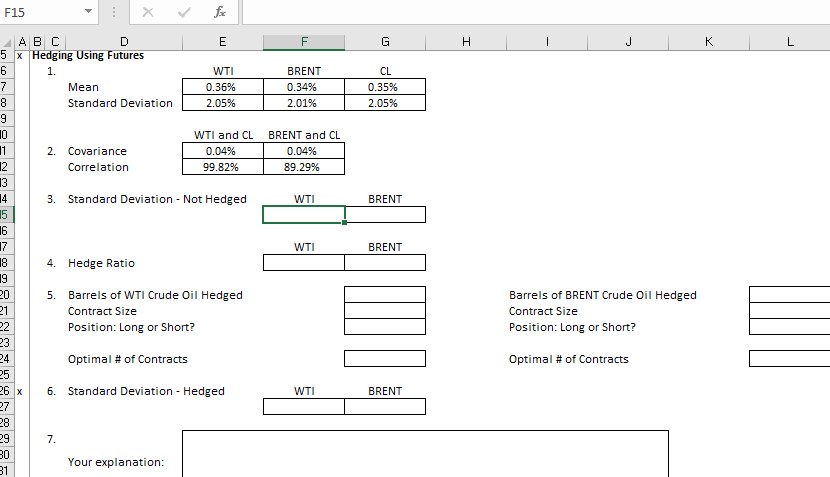

Question: 14 X A B C D E F G H Hedging Data Optimal Hedged Return Date WTI WTI Return BRENT BRENT Return CL CL Return

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts