Question: 14-01 *CLEARLY SHOW ANSWER - WILL UPVOTE CORRECT RESPONSE AS I CAN GRADE QUESTION IMMEDIATELY* Walk Through Residual Distribution Model Puckett Products is planning for

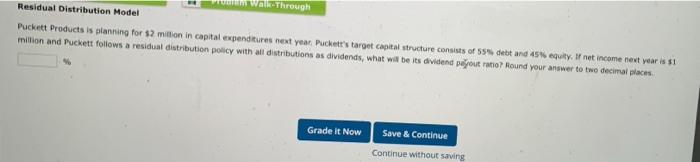

Walk Through Residual Distribution Model Puckett Products is planning for 12 million in capital expenditures next year Pucket's target capital structure consists of 55% debt and 454 equity. If net income next year is 51 million and Puckett follows a residual distribution policy with all distributions as dividends, what will be its dividend peout ratio? Round your answer to two decimal places Grade it Now Save & Continue Continue without saving

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts