Question: 14-50a) First Solution: The PW are correct and appropriate. Table cannot be shown as the rate is 16.79% approx. Alternative B should be prefered. as

14-50a)

First Solution:

The PW are correct and appropriate. Table cannot be shown as the rate is 16.79% approx.

Alternative B should be prefered. as NPV is less negative.

*******QUESTION: ANSWER PROBLEM BELOW*************

14-50b)

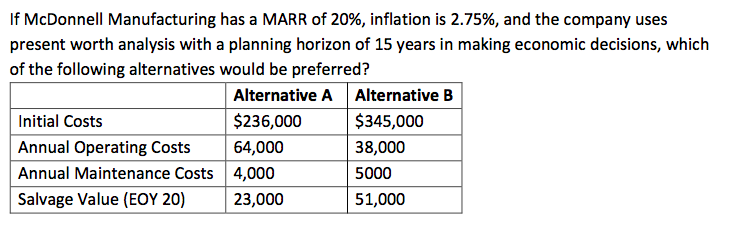

. Analyze the problem twice, using both nominal (actual dollar) and real (inflation- adjusted) analysis. Assume the annual cost estimates are for year-0. Assume the MARR of 20% represents the market rate unadjusted for purchasing power. Use Excel for this problem.

If McDonnell Manufacturing has a MARR of 20%, inflation is 2.75%, and the company uses present worth analysis with a planning horizon of 15 years in making economic decisions, which of the following alternatives would be preferred? Alternative A Alternative B Initial Costs $236,000 $345,000 Annual Operating costs 64,000 38,000 Annual Maintenance Costs 4,000 5000 Salvage Value (EOY 20) 23,000 51,000 A 1 Year 2 w N 3 4 5 6 7 00 ON B C D E F CFA CF B PVIF @16.79% PVA PVB 0 -236000 -345000 1.0000-236,000.00 -345000.00 1 -68000 -43000 0.8562-58,224.16 -36818.22 2 -680001 -43000 0.7331] -49,853.72 -31525.15 3 -68000 -43000 0.6277 -42,686.64 -26993.02 4 -680001 -43000 0.5375 -36,549.91 -23112.44 5 -68000 -43000 0.4602 -31,295.41 -19789.74 6 -680001 -43000 0.3941 -26,796.31 -16944.72 7 -68000 -43000 0.3374 -22,944.01 -14508.71 8 -68000 -43000 0.2889 -19,645.53 -12422.91 9 -68000 -43000 0.2474 -16,821.24 -10636.96 10 -68000 -43000 0.2118 -14,402.98 -9107.77 11 -68000 -43000 0.1814 -12,332.37 -7798.41 12 -68000 -43000 0.1553 -10,559.44 -6677.29 13 -68000 -43000 0.1330 -9,041.39 -5717.35 14 -68000 -43000 0.1138 -7,741.58 -4895.41 -45000 8000 0.0975 -4,386.60 779.84 NPV = -599,281.29 -571,168.27 10 11 12 13 14 15 16 17 15 18 If McDonnell Manufacturing has a MARR of 20%, inflation is 2.75%, and the company uses present worth analysis with a planning horizon of 15 years in making economic decisions, which of the following alternatives would be preferred? Alternative A Alternative B Initial Costs $236,000 $345,000 Annual Operating costs 64,000 38,000 Annual Maintenance Costs 4,000 5000 Salvage Value (EOY 20) 23,000 51,000 A 1 Year 2 w N 3 4 5 6 7 00 ON B C D E F CFA CF B PVIF @16.79% PVA PVB 0 -236000 -345000 1.0000-236,000.00 -345000.00 1 -68000 -43000 0.8562-58,224.16 -36818.22 2 -680001 -43000 0.7331] -49,853.72 -31525.15 3 -68000 -43000 0.6277 -42,686.64 -26993.02 4 -680001 -43000 0.5375 -36,549.91 -23112.44 5 -68000 -43000 0.4602 -31,295.41 -19789.74 6 -680001 -43000 0.3941 -26,796.31 -16944.72 7 -68000 -43000 0.3374 -22,944.01 -14508.71 8 -68000 -43000 0.2889 -19,645.53 -12422.91 9 -68000 -43000 0.2474 -16,821.24 -10636.96 10 -68000 -43000 0.2118 -14,402.98 -9107.77 11 -68000 -43000 0.1814 -12,332.37 -7798.41 12 -68000 -43000 0.1553 -10,559.44 -6677.29 13 -68000 -43000 0.1330 -9,041.39 -5717.35 14 -68000 -43000 0.1138 -7,741.58 -4895.41 -45000 8000 0.0975 -4,386.60 779.84 NPV = -599,281.29 -571,168.27 10 11 12 13 14 15 16 17 15 18Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts