Question: 1.48 points Save Answer QUESTION 10 Isaac has analyzed two mutually exclusive projects that have 3-vear lives. Project A has an NPV of $81,406, a

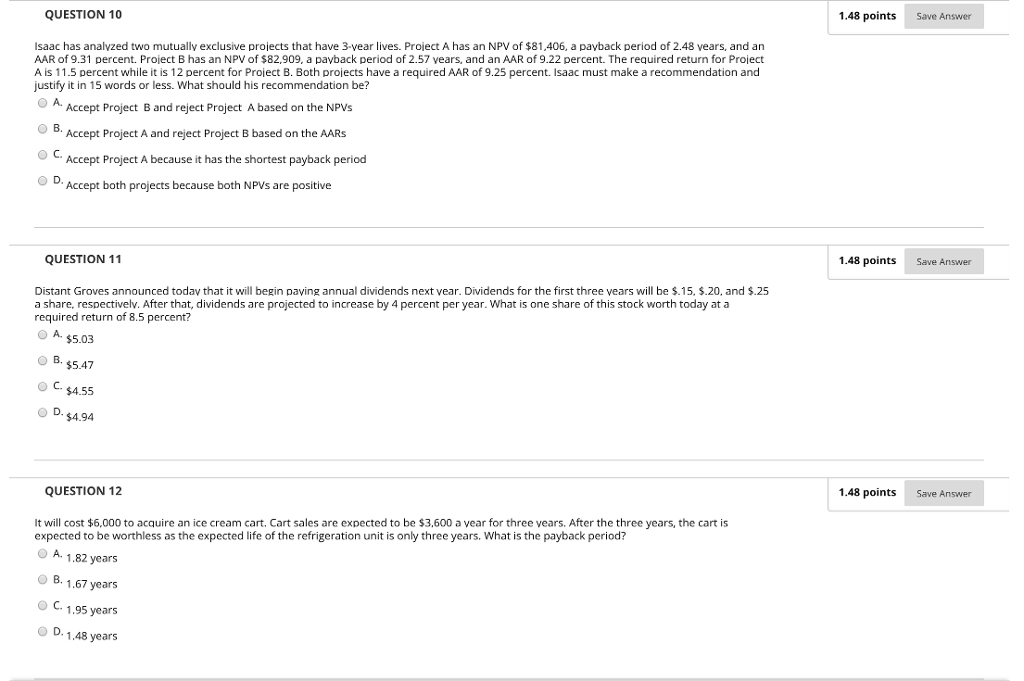

1.48 points Save Answer QUESTION 10 Isaac has analyzed two mutually exclusive projects that have 3-vear lives. Project A has an NPV of $81,406, a payback period of 2.48 vears, and an AAR of 9.31 percent. Project B has an NPV of $82,909, a payback period of 2.57 years, and an AAR of 9.22 percent. The required return for Project A is 11.5 percent while it is 12 percent for Project B. Both proiects have a required AAR of 9.25 percent. Isaac must make a recommendation and justify it in 15 words or less. What should his recommendation be? OA Accept Project B and reject Project A based on the NPVs O B. Accept Project A and reject Project B based on the AARs C.Accept Project A because it has the shortest payback period O D. Accept both projects because both NPVs are positive 1.48 points Save Answer QUESTION 11 Distant Groves announced today that it will begin paving annual dividends next vear. Dividends for the first three vears will be $.15, $.20, and $.25 a share, respectivelv. After that, dividends are projected to increase by 4 percent per year. What is one share of this stock worth today at a required return of 8.5 O A $5.03 percent? B. $5.47 . $4.55 O D. $4.94 1.48 points Save Answer QUESTION 12 It will cost $6,000 to acquire an ice cream cart. Cart sales are expected to be $3,600 a vear for three vears. After the three years, the cart is expected to be worthless as the expected life of the refrigeration unit is only three years. What is the payback period? O A. 1.82 years B. 1,67 years C.1.95 years O D. 1.48 years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts