Question: 1.48 points Save Answer QUESTION 22 A stock just paid dividends of $2.73 per share. Those dividends are expected to grow at a constant rate

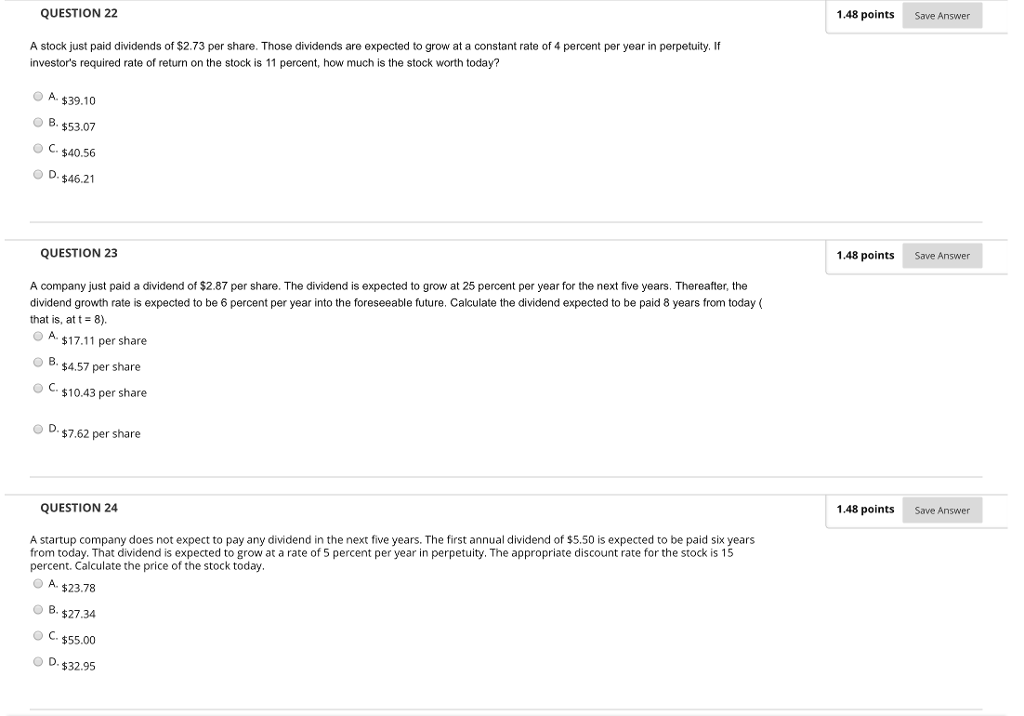

1.48 points Save Answer QUESTION 22 A stock just paid dividends of $2.73 per share. Those dividends are expected to grow at a constant rate of 4 percent per year in perpetuity. If investor's required rate of return on the stock is 11 percent, how much is the stock worth today? O A. $39.10 B. $53.07 C-$40.56 O D. $46.21 1.48 points Save Answer QUESTION 23 A company just paid a dividend of $2.87 per share. The dividend is expected to grow at 25 percent per year for the next five years. Thereafter, the dividend growth rate is expected to be 6 percent per year into the foreseeable future. Calculate the dividend expected to be paid 8 years from today( that is, at t- 8) OA $17.11 per share O B. $4.57 per share $10.43 per share OD. $7.62 per share 1.48 points Save Answer QUESTION 24 A startup company does not expect to pay any dividend in the next five years. The first annual dividend of $5.50 is expected to be paid six years from today. That dividend is expected to grow at a rate of S percent per year in perpetuity. The appropriate discount rate for the stock is 15 percent. Calculate the price of the stock today A. $23.78 OB. $27.34 C.$55.00 O D. $32.95

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts