Question: (1)/(5) 100% TOPIC 6: FORECASTING Practice Problems A firm has the following order history over the last 6 months. table[[Month,Order],[February,120],[March,95],[April,100],[May,75],[June,100],[July,50]] a. What would

(1)/(5)\

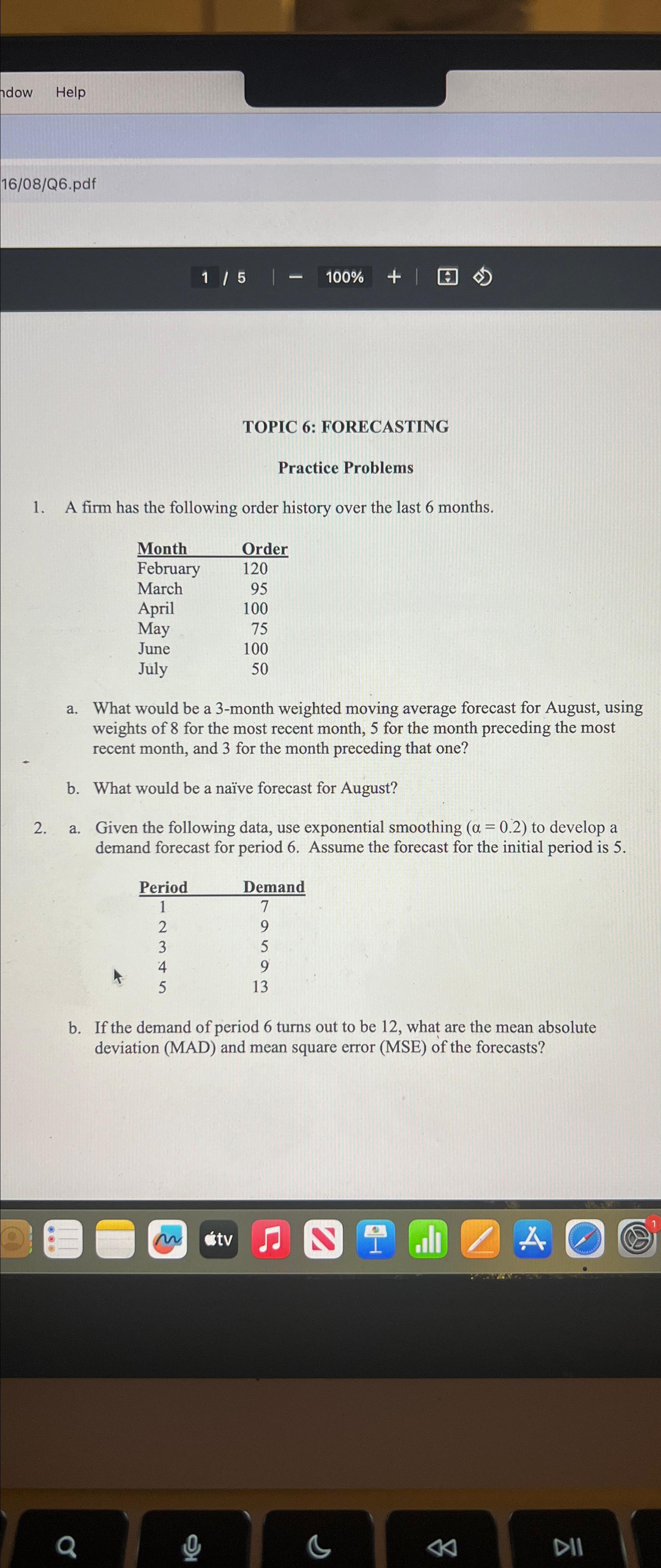

100%\ TOPIC 6: FORECASTING\ Practice Problems\ A firm has the following order history over the last 6 months.\ \\\\table[[Month,Order],[February,120],[March,95],[April,100],[May,75],[June,100],[July,50]]\ a. What would be a 3-month weighted moving average forecast for August, using weights of 8 for the most recent month, 5 for the month preceding the most recent month, and 3 for the month preceding that one?\ b. What would be a nave forecast for August?\ 2. a. Given the following data, use exponential smoothing

(\\\\alpha )

=(

0.2)to develop a demand forecast for period 6 . Assume the forecast for the initial period is 5 .\ \\\\table[[Period,Demand],[1,7],[2,9],[3,5],[4,9],[5,13]]\ b. If the demand of period 6 turns out to be 12 , what are the mean absolute deviation (MAD) and mean square error (MSE) of the forecasts?

TOPIC 6: FORECASTING Practice Problems 1. A firm has the following order history over the last 6 months. a. What would be a 3-month weighted moving average forecast for August, using weights of 8 for the most recent month, 5 for the month preceding the most recent month, and 3 for the month preceding that one? b. What would be a nave forecast for August? 2. a. Given the following data, use exponential smoothing (=0.2) to develop a demand forecast for period 6. Assume the forecast for the initial period is 5. b. If the demand of period 6 turns out to be 12 , what are the mean absolute deviation (MAD) and mean square error (MSE) of the forecasts

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts