Question: 15 & 16 SWERS ulate your equity. 14. 0.2860 Unit 15.3 Amortization with a financial calculator 15. Assume you get a 25-year $130,000 mortgage loan

15 & 16

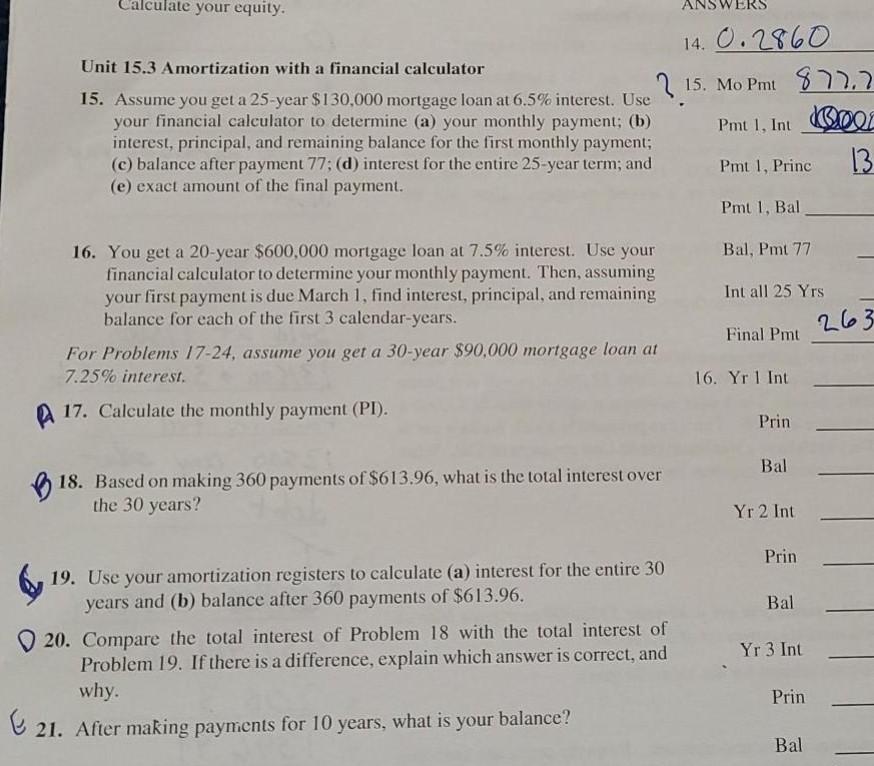

SWERS ulate your equity. 14. 0.2860 Unit 15.3 Amortization with a financial calculator 15. Assume you get a 25-year $130,000 mortgage loan at 6.5% interest. Use ? 15. Mo Pmt 877.2 your financial calculator to determine (a) your monthly payment; (b) interest, principal, and remaining balance for the first monthly payment; Pmt 1, Int (2001 (c) balance after payment 77; (d) interest for the entire 25-year term; and Pmt 1, Princ 13 (e) exact amount of the final payment. Pmt 1, Bal Bal, Pmt 77 16. You get a 20-year $600,000 mortgage loan at 7.5% interest. Use your financial calculator to determine your monthly payment. Then, assuming your first payment is due March 1, find interest, principal, and remaining balance for each of the first 3 calendar-years. For Problems 17-24, assume you get a 30-year $90,000 mortgage loan at 7.25% interest. A 17. Calculate the monthly payment (PI). Int all 25 Yrs Final Pmt 263 16. Yr 1 Int Prin Bal 18. Based on making 360 payments of $613.96, what is the total interest over the 30 years? Yr 2 Int Prin Bal 19. Use your amortization registers to calculate (a) interest for the entire 30 years and (b) balance after 360 payments of $613.96. 20. Compare the total interest of Problem 18 with the total interest of Problem 19. If there is a difference, explain which answer is correct, and why. Yr 3 Int Prin 21. After making payments for 10 years, what is your balance? Bal

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts