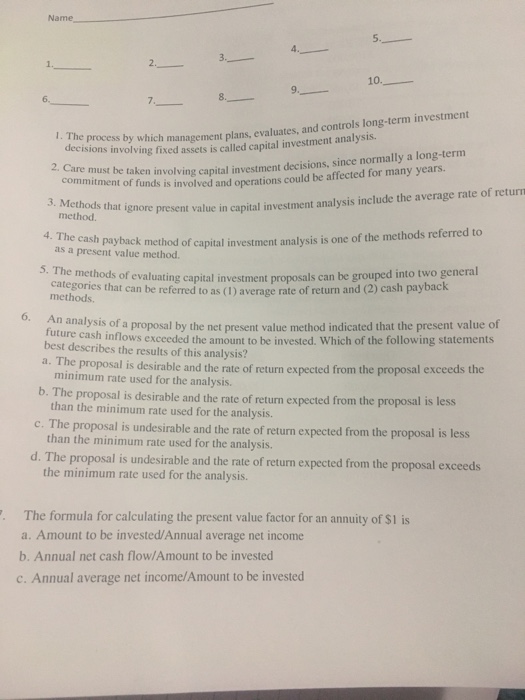

Question: 1-5 are true /false. 6-7 multiple choice The process by which management plans, evaluates, and controls long-term investment decisions involving fixed called capital investment analysis.

The process by which management plans, evaluates, and controls long-term investment decisions involving fixed called capital investment analysis. Care must be taken involving capital investment decisions, since normally a long-term commitment of funds is involved and operations could be affected for many years. Methods that ignore present value in capital investment analysis include the average rate of return method. The cash payback method of capital investment analysis is one of the methods referred to as a present value method. The methods of evaluating capital investment proposals can be grouped into two general categories that can be referred to as (1) average rate of return and (2) cash payback An analysis of a proposal by the net present value method indicated that the present value of future cash inflows exceeded the amount to be invested. Which of the following statements best describes the results of this analysis? The proposal is of return expected from the proposal exceeds the minimum rate used for the analysis. The proposal is desirable and the rate of return expected from the proposal is less than the minimum rate used for the analysis. The proposal is undesirable and the rate of return expected from the proposal is less than the minimum rate used the analysis. The proposal is undesirable and the rate of return expected from the proposal exceeds the minimum rate used for the analysis. The formula for calculating the present value factor for an annuity of $1 is Amount to be invested/Annual average net income Annual net cash flow/Amount to be invested Annual average net income/Amount to be invested

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts