Question: 15. Chapter MC, Section 18, Problem 070 bols s Bob has a $50,000 stock portfolio with a beta of 1.2, an expected return of 10.8%,

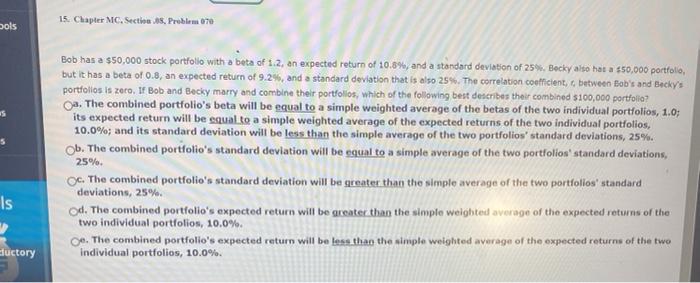

15. Chapter MC, Section 18, Problem 070 bols s Bob has a $50,000 stock portfolio with a beta of 1.2, an expected return of 10.8%, and a standard deviation of 25%. Becky also hat a 50,000 portfolio, but it has a beta of 0.8, an expected return of 9.2%, and a standard deviation that is also 25%. The correlation coefficient, a between Bob's and Becky's portfolios is zero. If Bob and Becky marry and combine their portfolios, which of the following best describes their combined $100,000 portfolio? a. The combined portfolio's beta will be equal to a simple weighted average of the betas of the two individual portfolios, 1.0; its expected return will be equal to a simple weighted average of the expected returns of the two individual portfolios, 10.0%; and its standard deviation will be less than the simple average of the two portfolios' standard deviations, 25%. Ob. The combined portfolio's standard deviation will be equal to a simple average of the two portfolios standard deviations, 25%. Oc. The combined portfolio's standard deviation will be greater than the simple average of the two portfolios standard deviations, 25%. Od. The combined portfolio's expected return will be greater than the simple weighted average of the expected returns of the two individual portfolios, 10.0%. ce. The combined portfolio's expected return will be less than the simple weighted average of the expected returns of the two individual portfolios, 10.0% Is luctory

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts