Question: 15. Gertup has maintained the same inventory levels throughout 2005. If end of year inventory turnover was increased to 12 through more efficient relationships with

| 15. | Gertup has maintained the same inventory levels throughout 2005. If end of year inventory turnover was increased to 12 through more efficient relationships with suppliers, how much cash would be freed up (pick closest number)?

|

| 16. | Due to competitive pressures, Gertup has had to increase credit terms to customers to maintain sales. This resulted in Gertup's accounts receivable doubling from 12/31/04 to 12/31/05. The average accounts receivable turnover was 30 days. Without the increased credit terms, accounts receivable turnover would have remained at 12/31/04 levels. The impact of the change in credit policy was:

|

| 17. | Gertup has increased its borrowing since last year, in part to finance the increased credit terms offered to customers. Which of the following actions would not decrease its borrowing?

|

| 18. | If sales increased by 10% per annum for the next 20 years, sales for year 2025 would be closest to

|

| 19. | Over time, what observation(s) best characterizes how ROE for a given firm should behave? I. ROE will increase because the firm becomes more efficient. II. ROE will decrease because competition will erode profitability. III. The answer depends on how conservative the firm's accounting policies are, which affects its reported earnings.

please give the answer step by step |

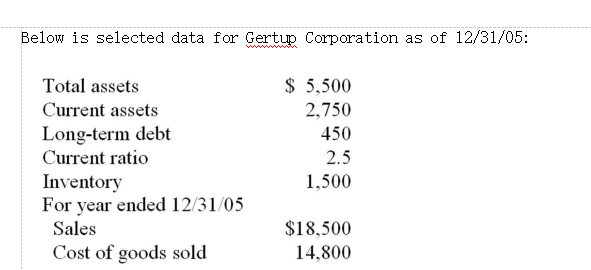

Below is selected data for Gertup Corporation as of 12/31/05: $ 5,500 2,750 Total assets Current assets Long-term debt Current ratio Inventory For year ended 12/31/05 450 2.5 1,500 $18,500 14,800 Cost of goods sold

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts