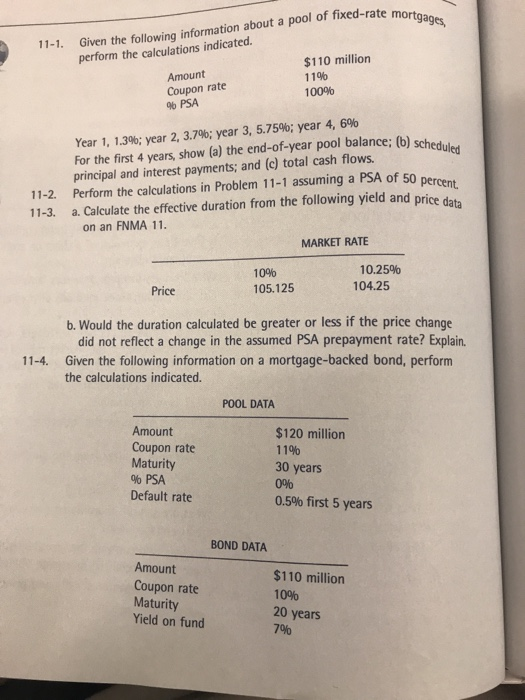

Question: 1-5 Help! 11-1. Given the following information about a pool of fixed-rate mort perform the calculations indicated. Amount Coupon rate %PSA $110 million 1196 100%

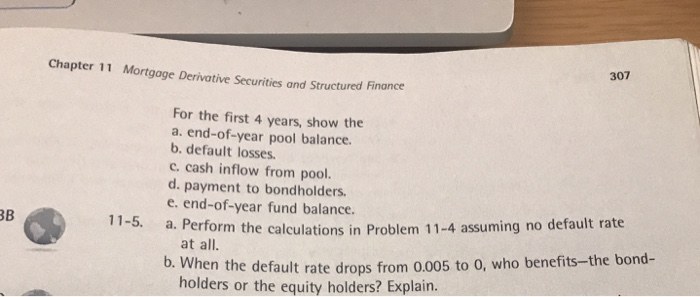

11-1. Given the following information about a pool of fixed-rate mort perform the calculations indicated. Amount Coupon rate %PSA $110 million 1196 100% Year 1, 1.3%; year 2. 3.7%; year 3, 5.75%; year 4,6% For the first 4 years, show (a) the end-of-year pool balance: (b) scheduled principal and interest payments; and (c) total cash flows.d 11-2. Perform the calculations in Problem 11-1 assuming a PSA of 50 percent 11-3. a. Calculate the effective duration from the following yield and price data on an FNMA 11. MARKET RATE 1090 105.125 10.25% 104.25 Price b. Would the duration calculated be greater or less if the price change did not reflect a change in the assumed PSA prepayment rate? Explain. Given the following information on a mortgage-backed bond, perform the calculations indicated. 11-4. POOL DATA Amount Coupon rate Maturity %PSA Default rate $120 million 11% 30 years 0% 0.5% first 5 years BOND DATA Amount Coupon rate Maturity Yield on fund $110 million 1096 20 years 7%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts