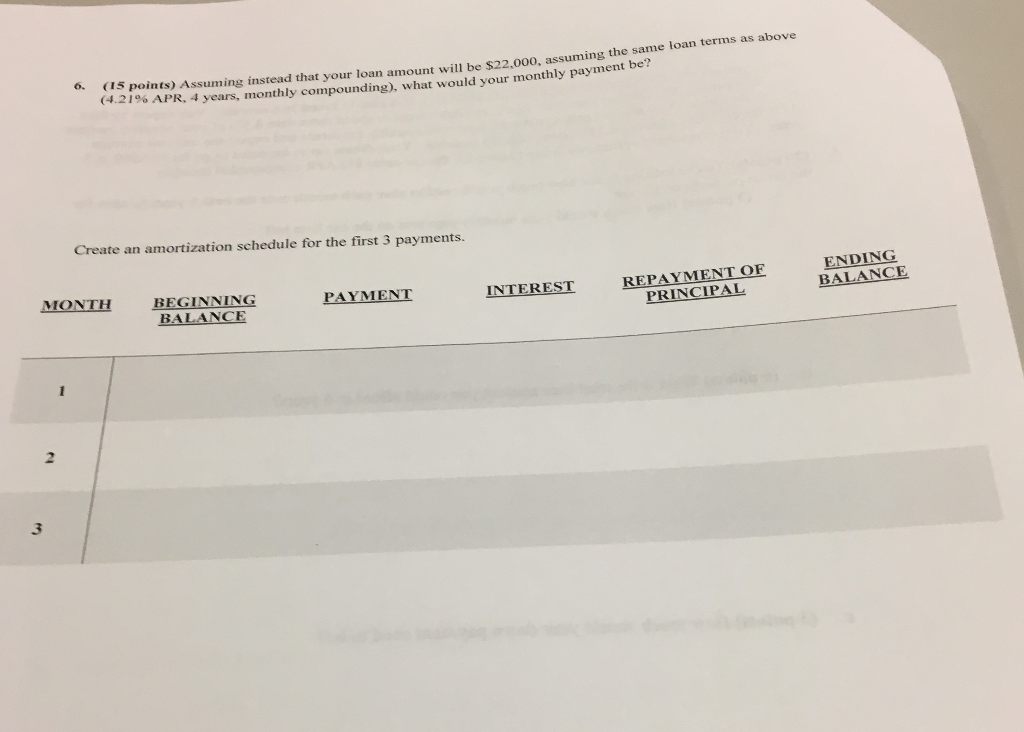

Question: (15 points) Assuming instead that your loan amount will be $22,000, assuming the same loan terms as above (4.219% APR, 6. years, monthly compounding), what

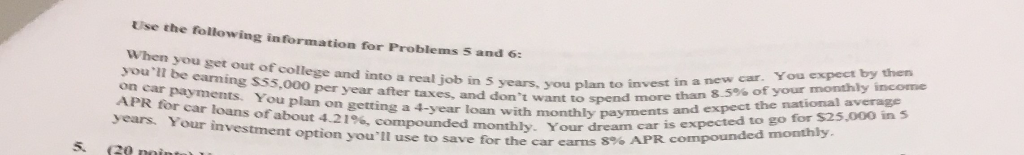

(15 points) Assuming instead that your loan amount will be $22,000, assuming the same loan terms as above (4.219% APR, 6. years, monthly compounding), what would your monthly payment be?. Create an amortization schedule for the first 3 payments. ENDING MONTH REPAYMENT OF PRINCIPAL BEGINNING BALANCE PAYMENT INTEREST BALANCE 1 2 Use the following information for Problems 5 and 6: When you get out of college and into a real job in 5 years. you pla more than 8.5% of your monthly income new car. You expect by then n to invest in you'll be earning $55,000 per year after taxes, and don't want on car payments. You plan on getting a 4-year loan with monthly payments and expect the national average APR for car loans of about 4.21%, compounded monthly. Your dream car is expected to go for $25,000 in S years. Your investment option you'll use to save for the car ears 8% APR compounded monthly. (20 poins- 5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts