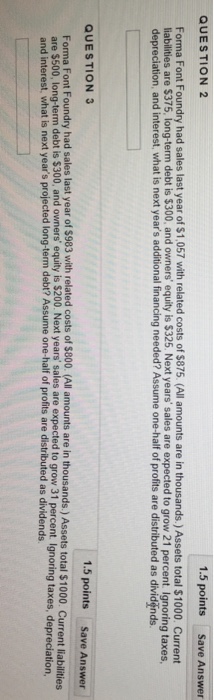

Question: 1.5 points Save Answer QUESTION 2 had sales last year of $1,057 with related costs of $875. (All amounts are in thousands.) Assets total $1000.

1.5 points Save Answer QUESTION 2 had sales last year of $1,057 with related costs of $875. (All amounts are in thousands.) Assets total $1000. Current liabilities are $375, long-term debt is $300, and owners' equity is $325. Next years' sales are expected to grow 21 percent Ignoring taxes, depreciation, and interest, what is next years additional financing needed? Assume one -half of profits are distributed as dividgnds QUESTION 3 1.5 points Save Answer Forma Font Foundry had sales last year of $983 with related costs of $800. (All amounts are in thousands.) Assets total $1000. Current are $500, long-term debt is $300, and owners' equity is $200. Next years' sales are ex and interest, what is next year's projected long-term debt? Assume one-half of profits are distributed as dividends liabilities pected to grow 31 percent. Ignoring taxes, depreciation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts