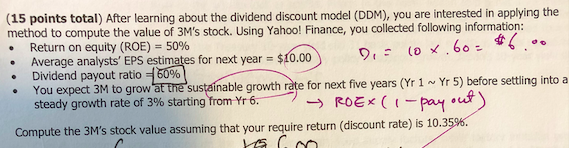

Question: (15 points total) After learning about the dividend discount model (DDM), you are interested in applying the method to compute the value of 3M's stock.

(15 points total) After learning about the dividend discount model (DDM), you are interested in applying the method to compute the value of 3M's stock. Using Yahoo! Finance, you collected following information Return on equity (ROE) 50% Average analysts' EPS estimates for next year $10.00 Dividend payout ratio-16000 You expect 3M to grow at the sustainable growth rate for next five years steady growth rate of 3% starting Trom Yr 6:-/-) ROE x ( (-pa ( out ) sts' EPS estimates for next year . Yr 5) before settling into a (Yr 1 mpute the 3M's stock value assuming that your require return (discount rate) is 10.359%

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock