Question: 15. Problem 11.20 - NPV (difficult question) Click here to read the eBook: Net Present Value (NPV) Click here to read the eBook: Internal Rate

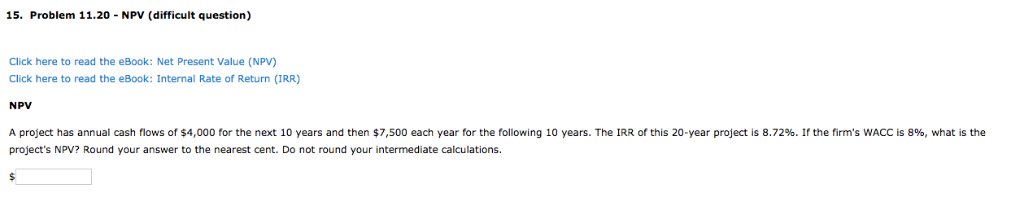

15. Problem 11.20 - NPV (difficult question) Click here to read the eBook: Net Present Value (NPV) Click here to read the eBook: Internal Rate of Return (IRR) NPV A project has annual cash flows of $4,000 for the next 10 years and then $7,500 each year for the following 10 years. The IRR of this 20-year project is 8.72%. If the firm's WACC is 8%, what is the project's NPV? Round your answer to the nearest cent. Do not round your intermediate calculations

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts