Question: 15 Problem 5-24 Leverage and sensitivity analysis [LO5-6 Edsel Research Labs has $27 illion in assets. Curr with common stock having a par value of

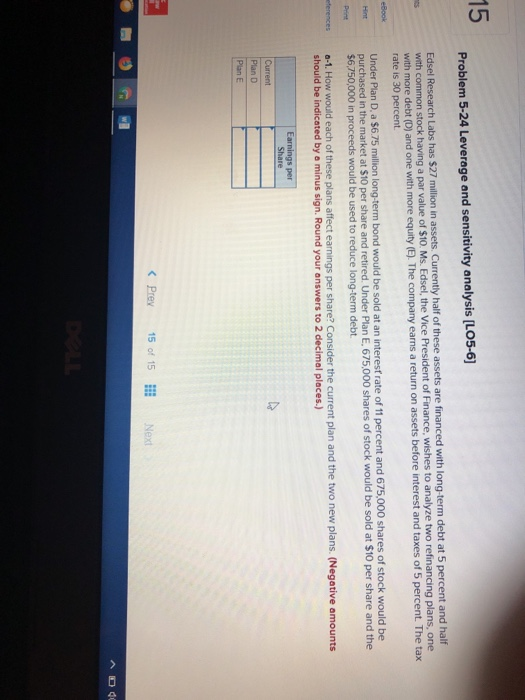

15 Problem 5-24 Leverage and sensitivity analysis [LO5-6 Edsel Research Labs has $27 illion in assets. Curr with common stock having a par value of $10. Ms. Edsel, the Vice President of Finance, wishes to analyze two ref ently half of these assets are financed with long-term debt at 5 percent and half one with more equity (E. The company earns a return on assets before interest and taxes of 5 percent. The tax rate is 30 percent a $6.75 million long-term bond would be sold at an interest rate of 11 percent and 675,000 shares of stock would be Under Plan D, purchased in the market at $10 per share and retired. Under Plan E. 675,000 shares of stock would be sold at $10 per share and the $6,750,000 in proceeds would be used to reduce long-term debt terences a-1. How would each of these plans affect earnings per share? Consider the current plan and the two new plans. (Negative amounts should be indicated by a minus sign. Round your answers to 2 decimal places ngs per Share de Plan D Plan E Prev 15 of 15 Next

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts