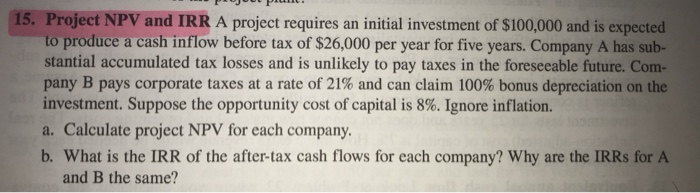

Question: 15. Project NPV and IRR A project requires an initial investment of $100,000 and is expected to produce a cash inflow before tax of $26,000

15. Project NPV and IRR A project requires an initial investment of $100,000 and is expected to produce a cash inflow before tax of $26,000 per year for five years. Company A has sub- stantial accumulated tax losses and is unlikely to pay taxes in the foreseeable future. Com pany B pays corporate taxes at a rate of 21% and can claim 100% bonus depreciation on the investment. Suppose the opportunity cost of capital is 8%. Ignore inflation. a. Calculate project NPV for each company. b. What is the IRR of the after-tax cash flows for each company? Why are the IRRs for A and B the same

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock