Question: 15 (Taxable Income - Bracket Floor) A A | B l c l D l E F G H 1 27 Income Tax Calculation Using

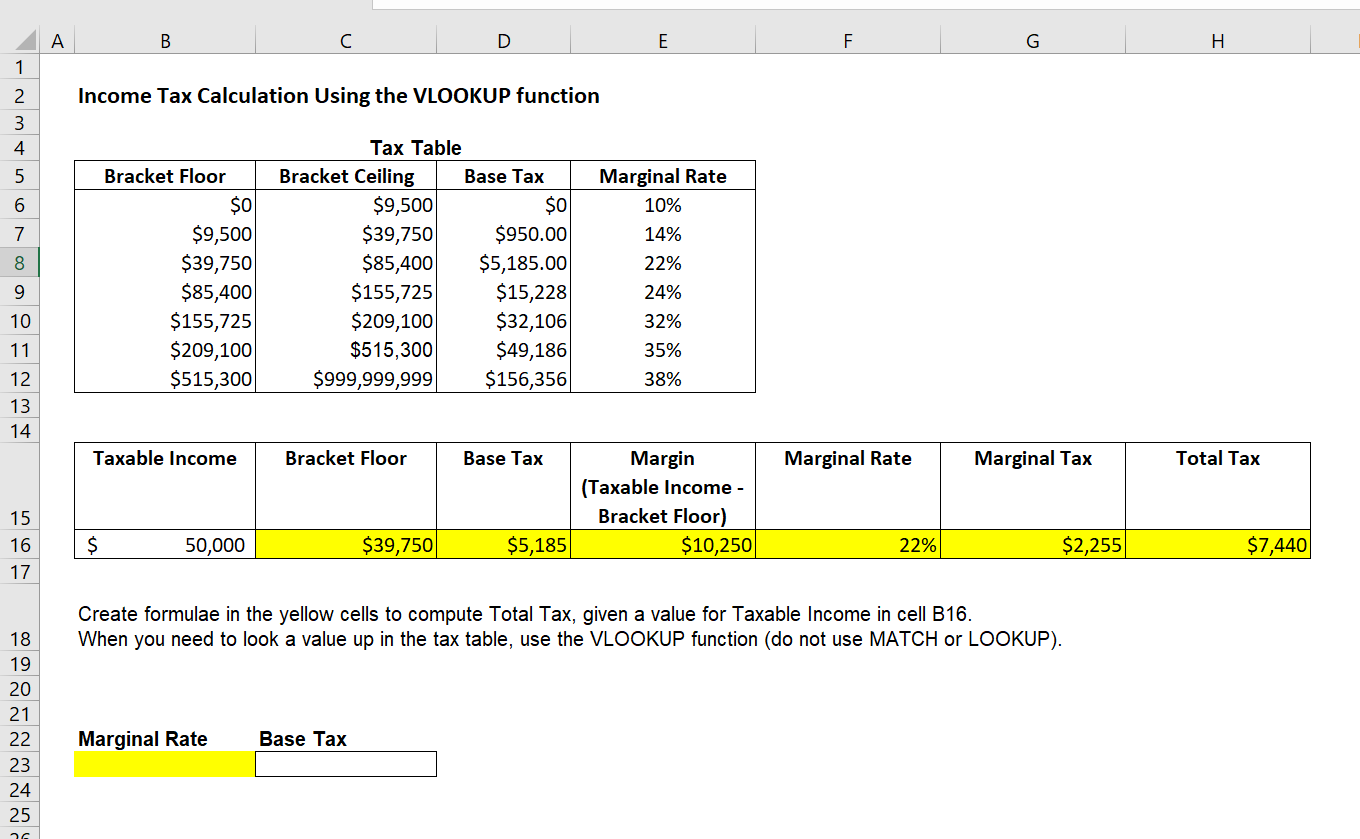

15 (Taxable Income - Bracket Floor) A A | B l c l D l E F G H 1 27 Income Tax Calculation Using the VLOOKUP function 3 4 Tax Table 5 Bracket Floor Bracket Ceiling Base Tax Marginal Rate 6_ $0 $9,500 $0 10% L $9,500 $39,750 $950.00 14% i $39,750 $85,400 $5,185.00 22% 9 $85,400 $155,725 $15,228 24% 10 $155,725 $209,100 $32,106 32% 11 $209,100 $515,300 $49,186 35% 12 $515,300 $999,999,999 $156,356 38% 12 14 Taxable Income Bracket Floor Base Tax Margin Marginal Rate Marginal Tax Total Tax 16 5 50,000 $39,750 $5,185 $10,250 22% $2,255 $7,440 17 1B 19 20 21 22 23 24 25 'IL' Create formulae in the yellow cells to compute Total Tax, given a value for Taxable Income in cell B16. When you need to look a value up in the tax table, use the VLOOKUP function (do not use MATCH 0r LOOKUP). Marginal Rate Base Tax

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts