Question: 15. The basic requirements for an effective financial system in developed economy included A) Markets for the transfer of financial assets B) Monetary system C)

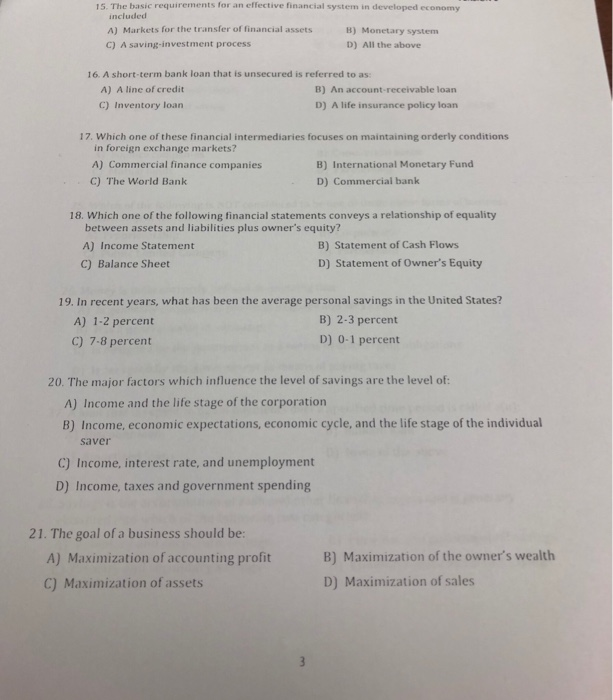

15. The basic requirements for an effective financial system in developed economy included A) Markets for the transfer of financial assets B) Monetary system C) A saving investment process D) All the above 16. A short-term bank loan that is unsecured is referred to as: A) A line of credit B) An account-receivable loan C) Inventory loan D) A life insurance policy loan 17. Which one of these financial intermediaries focuses on maintaining orderly conditions in foreign exchange markets? A) Commercial finance companies B) International Monetary Fund C) The World Bank D) Commercial bank 18. Which one of the following financial statements conveys a relationship of equality between assets and liabilities plus owner's equity? A) Income Statement B) Statement of Cash Flows C) Balance Sheet D) Statement of Owner's Equity 19. In recent years, what has been the average personal savings in the United States? A) 1-2 percent B) 2-3 percent C) 7-8 percent D) 0-1 percent 20. The major factors which influence the level of savings are the level of: A) Income and the life stage of the corporation B) Income, economic expectations, economic cycle, and the life stage of the individual saver C) Income, interest rate, and unemployment D) Income, taxes and government spending 21. The goal of a business should be: A) Maximization of accounting profit C) Maximization of assets B) Maximization of the owner's wealth D) Maximization of sales

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts