Question: 15. The replacement chain approach - Evaluating projects with unequal lives Evaluating projects with unequal lives Your company is considering starting a new project in

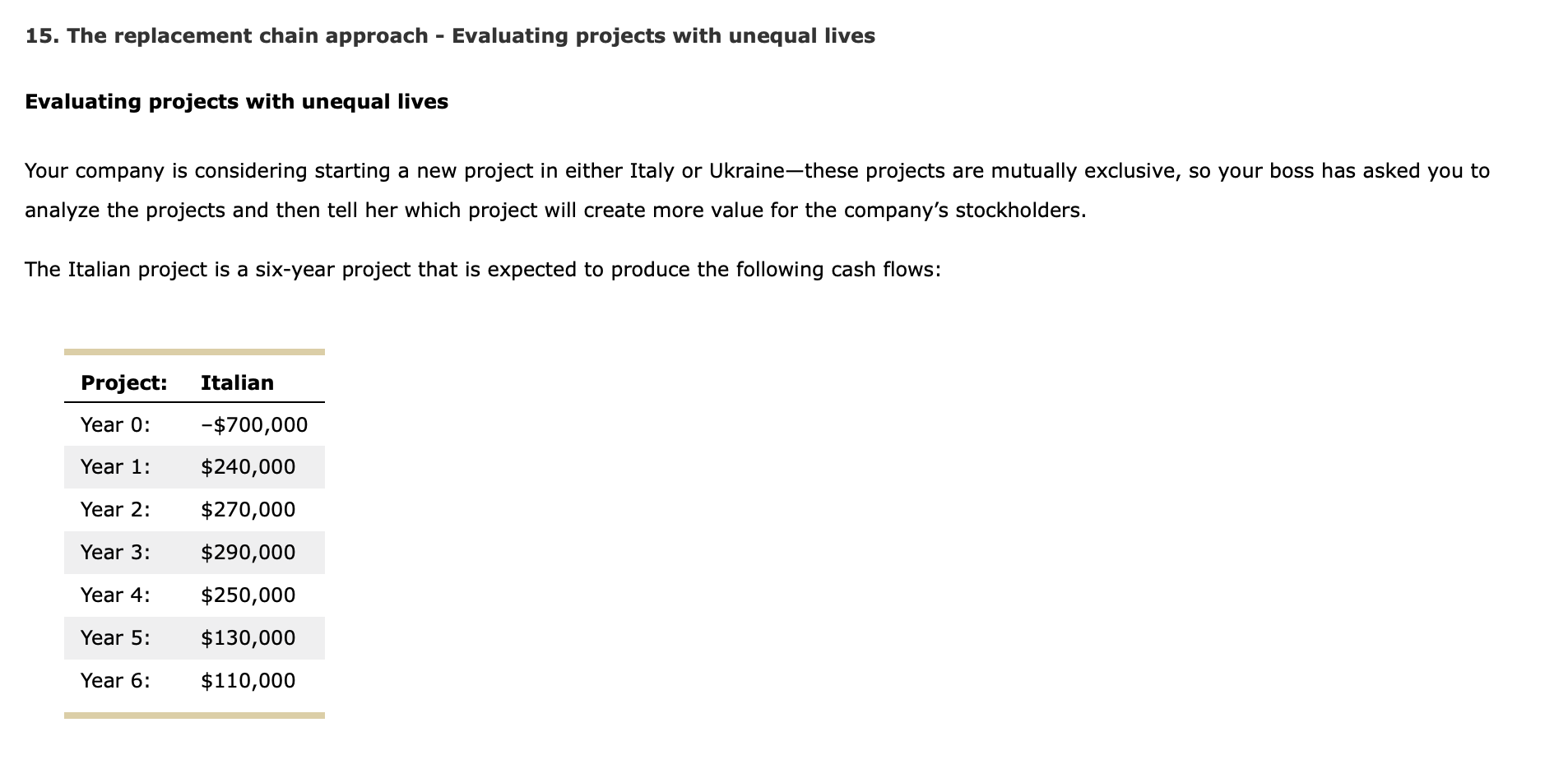

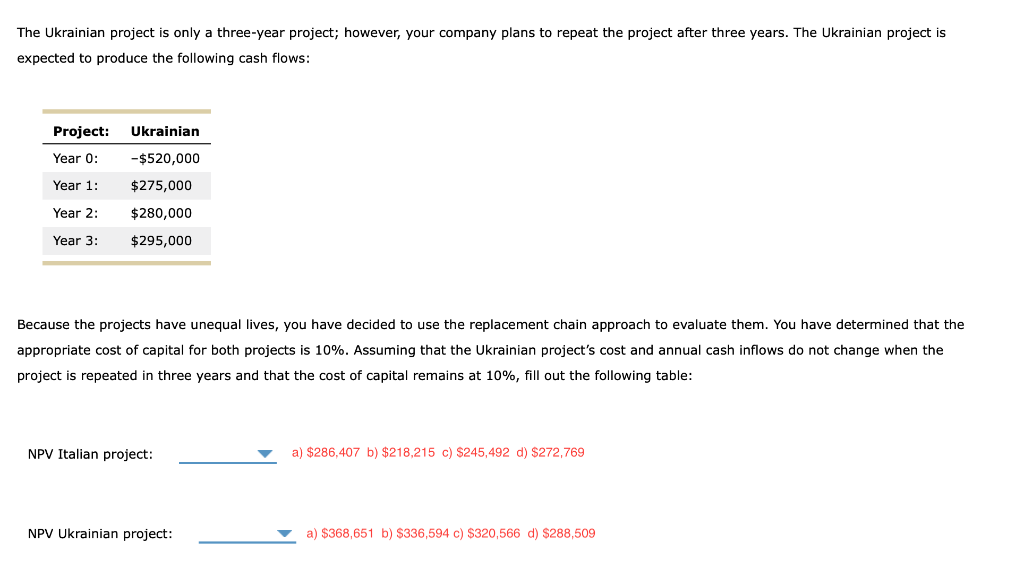

15. The replacement chain approach - Evaluating projects with unequal lives Evaluating projects with unequal lives Your company is considering starting a new project in either Italy or Ukraine-these projects are mutually exclusive, so your boss has asked you to analyze the projects and then tell her which project will create more value for the company's stockholders. The Italian project is a six-year project that is expected to produce the following cash flows: Project: Italian Year 0: Year 1: Year 2: Year 3: -$700,000 $240,000 $270,000 $290,000 $250,000 $130,000 $110,000 Year 4: Year 5: Year 6: The Ukrainian project is only a three-year project; however, your company plans to repeat the project after three years. The Ukrainian project is expected to produce the following cash flows: Project: Year 0: Year 1: Year 2: Year 3: Ukrainian -$520,000 $275,000 $280,000 $295,000 Because the projects have unequal lives, you have decided to use the replacement chain approach to evaluate them. You have determined that the appropriate cost of capital for both projects is 10%. Assuming that the Ukrainian project's cost and annual cash inflows do not change when the project is repeated in three years and that the cost of capital remains at 10%, fill out the following table: NPV Italian project: a) $286,407 b) $218,215 c) $245,492 d) $272,769 NPV Ukrainian project: a) $368,651 b) $336,594 c) $320,566 d) $288,509

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts