Question: 15. The replacement chain approach - Evaluating projects with unequal lives Evaluating projects with unequal lives Savory Seafood is a U.S. firm that wants to

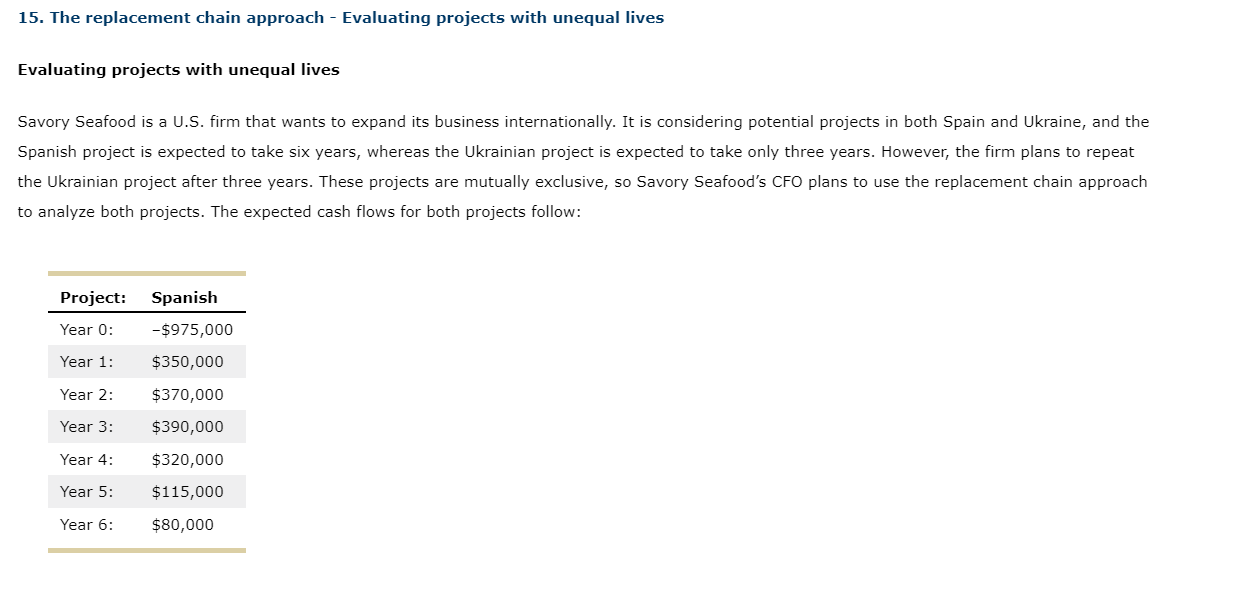

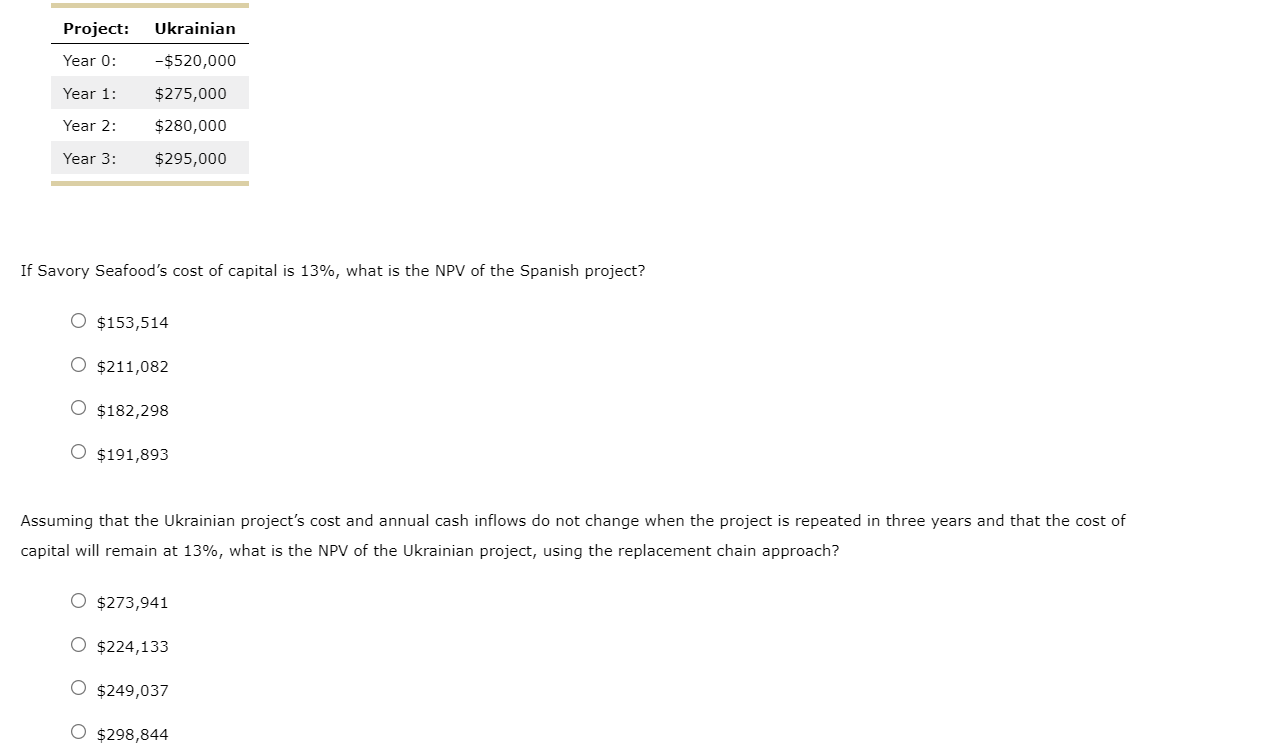

15. The replacement chain approach - Evaluating projects with unequal lives Evaluating projects with unequal lives Savory Seafood is a U.S. firm that wants to expand its business internationally. It is considering potential projects in both Spain and Ukraine, and the Spanish project is expected to take six years, whereas the Ukrainian project is expected to take only three years. However, the firm plans to repeat the Ukrainian project after three years. These projects are mutually exclusive, so Savory Seafood's CFO plans to use the replacement chain approach to analyze both projects. The expected cash flows for both projects follow: Project: Spanish Year 0: -$975,000 Year 1: $350,000 Year 2: $370,000 Year 3: $390,000 Year 4: $320,000 $115,000 Year 5: Year 6: $80,000 Project: Ukrainian Year O: -$520,000 Year 1: $275,000 Year 2: $280,000 $295,000 Year 3: If Savory Seafood's cost of capital is 13%, what is the NPV of the Spanish project? $153,514 O $211,082 $182,298 $191,893 Assuming that the Ukrainian project's cost and annual cash inflows do not change when the project is repeated in three years and that the cost of capital will remain at 13%, what is the NPV of the Ukrainian project, using the replacement chain approach? O $273,941 $224,133 O $249,037 O $298,844

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts