Question: (15) Western Fronts is being acquired by Eastern Slopes for $30,000 worth of Eastern Slopes stock. The incremental value of the acquisition is $2,000. Western

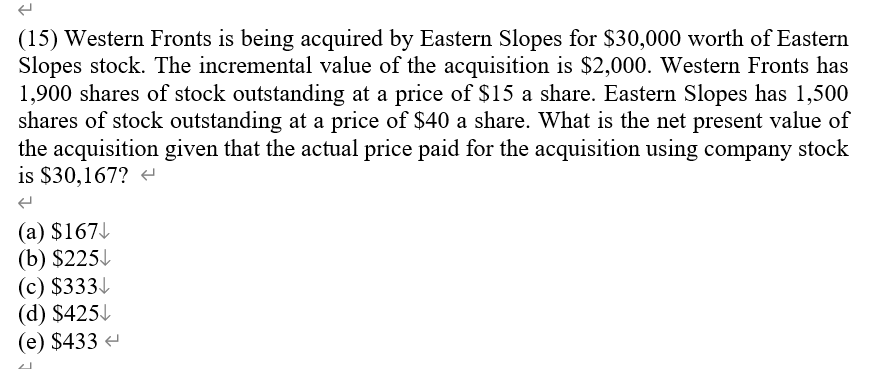

(15) Western Fronts is being acquired by Eastern Slopes for $30,000 worth of Eastern Slopes stock. The incremental value of the acquisition is $2,000. Western Fronts has 1,900 shares of stock outstanding at a price of $15 a share. Eastern Slopes has 1,500 shares of stock outstanding at a price of $40 a share. What is the net present value of the acquisition given that the actual price paid for the acquisition using company stock is $30,167? + (a) $167) (b) $225 (c) $3331 (d) $425 (e) $433

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts