Question: 15. When computing tax depreciation in the first year for new equipment the has a recovery period of less than 20 years, you ... a

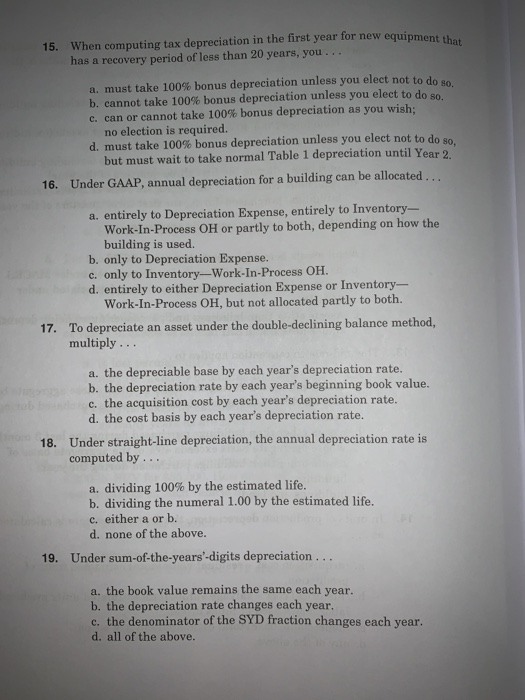

15. When computing tax depreciation in the first year for new equipment the has a recovery period of less than 20 years, you ... a must take 100% bonus depreciation unless you elect not to de b. cannot take 100% bonus depreciation unless you elect to do c. can or cannot take 100% bonus depreciation as you wish; no election is required. d. must take 100% bonus depreciation unless you elect not to do sa but must wait to take normal Table 1 depreciation until Year 2. 16. Under GAAP, annual depreciation for a building can be allocated... a. entirely to Depreciation Expense, entirely to Inventory- Work-In-Process OH or partly to both, depending on how the building is used. b. only to Depreciation Expense. c. only to Inventory_Work-In-Process OH. d. entirely to either Depreciation Expense or Inventory- Work-In-Process OH, but not allocated partly to both. 17. To depreciate an asset under the double-declining balance method, multiply... a. the depreciable base by each year's depreciation rate. b. the depreciation rate by each year's beginning book value. c. the acquisition cost by each year's depreciation rate. d. the cost basis by each year's depreciation rate. 18. Under straight-line depreciation, the annual depreciation rate is computed by... a. dividing 100% by the estimated life. b. dividing the numeral 1.00 by the estimated life. c. either a or b. d. none of the above. 19. Under sum-of-the-years-digits depreciation... a. the book value remains the same each year. b. the depreciation rate changes each year. c. the denominator of the SYD fraction changes each year. d. all of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts