Question: 15. You are presented with two options: Option A - Three annual, end-of-year payments of $1,000 each (the first payment occurs one year from today),

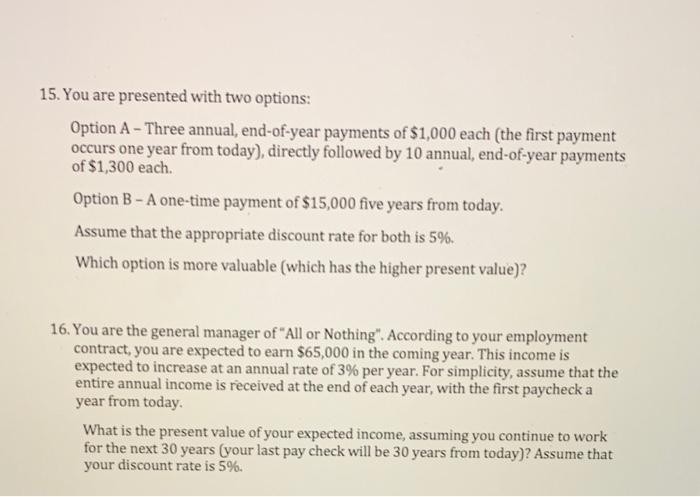

15. You are presented with two options: Option A - Three annual, end-of-year payments of $1,000 each (the first payment occurs one year from today), directly followed by 10 annual, end-of-year payments of $1,300 each Option B - A one-time payment of $15,000 five years from today. Assume that the appropriate discount rate for both is 5%. Which option is more valuable (which has the higher present value)? 16. You are the general manager of "All or Nothing". According to your employment contract, you are expected to earn $65,000 in the coming year. This income is expected to increase at an annual rate of 3% per year. For simplicity, assume that the entire annual income is received at the end of each year, with the first paycheck a year from today. What is the present value of your expected income, assuming you continue to work for the next 30 years (your last pay check will be 30 years from today)? Assume that your discount rate is 5%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts