Question: 15 You work for Microsoft Corporation (ticker: MSFT), and you are considering whether to develop a new software product. The risk of the investment is

15

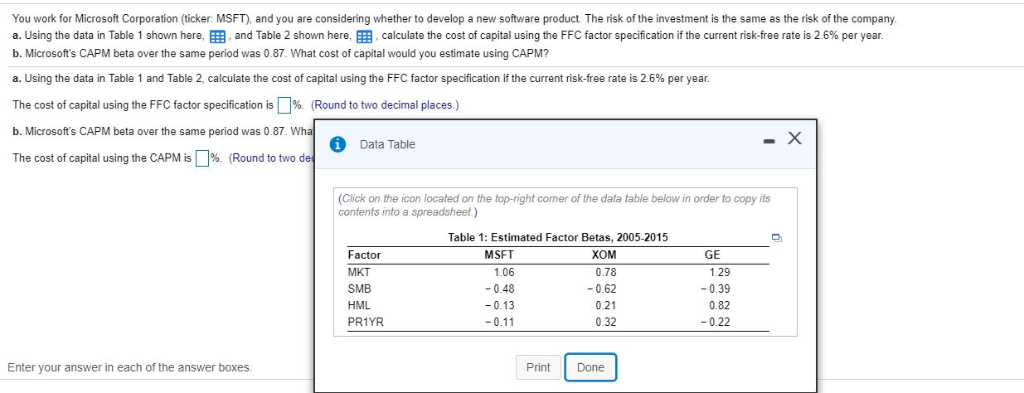

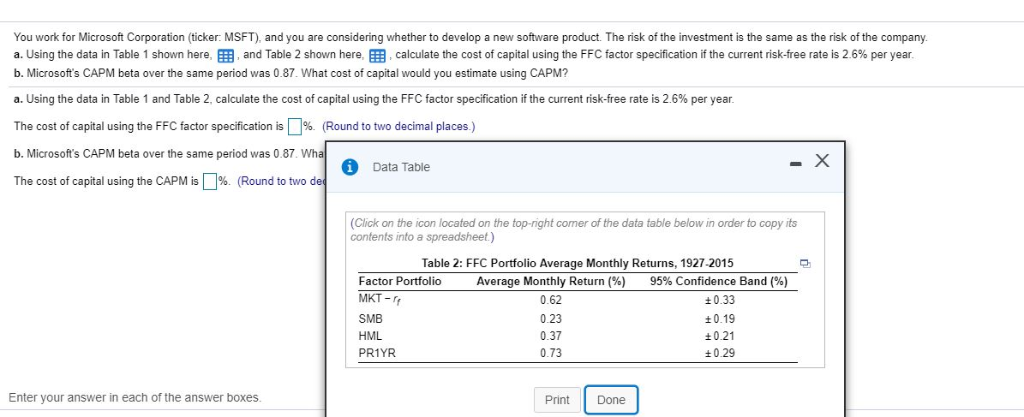

You work for Microsoft Corporation (ticker: MSFT), and you are considering whether to develop a new software product. The risk of the investment is the same as the risk of the company a using the data in Table 1 shown here and Table 2 shown here. calculate the cost of capital using the FFC factor specification if the current risk-free rate is 26% per year. b. Microsoft's CAPM beta over the same period was 0.87. What cost of capital would you estimate using CAPM? a. Using the data in Table 1 and Table 2, calculate the cost of capital using the FFC factor specification if the current risk-free rate is 2.6% per year. The cost of capital using the FFC factor specification is 96 (Round to two decimal places.) b. Microsoft's CAPM beta over the same period was 0.87. What cost of capital would you estimate using CAPM? The cost of capital using the CAPM is%Round to two decimal places.) You work for Microsoft Corporation (ticker: MSFT), and you are considering whether to develop a new software product. The risk of the investment is the same as the risk of the company a. Using the data in Table 1 shown here and Table 2 shown here calculate the cost o capital using he FFC factor specification if the current risk-free rate is 2.6% per year b. Microsoft's CAPM beta over the same period was 0.87. What cost of capital would you estimate using CAPM? a. Using the data in Table 1 and Table 2, calculate the cost of capital using te FFC factor specification if the current risk-free rate is 2.6% per year. The cost of capital using the FFC factor specification is | % (Round to two decimal places ) b. Microsoft's CAPM beta over the same period was 0.87 Data Table The cost of capital using the CAPM is%Round to two (Click on the icon locafed on the fop-right comer of the data table below in order to copy its contents into a spreadsheet) Table 1: Estimated Factor Betas, 2005-2015 Factor MKT SMB HML PR1YR MSFT 1.06 -0.48 -0.13 XOM 0.78 -0.62 0.21 0.32 GE 1.29 -0.39 0.82 -0.22 Enter your answer in each of the answer boxes. Print Done You work for Microsoft Corporation (ticker: MSFT), and you are considering whether to develop a new software product. The risk of the investment is the same as the risk of the company a. Using the data in Table 1 shown here and Table 2 shown here. calculate the cost of capital using he FFC factor specification the current sk-free rate is 2.6% per year b. Microsofts CAPM beta over the same period was 0.87. What cost of capital would you estimate using CAPM? a. Using the data in Table 1 and Table 2, calculate the cost of capital using the FFC factor specification if the current risk-free rate is 2.6% per year. The cost of capital using the FFC factor specification is | %. (Round to two decimal places) b. Microsoftfs CAPM beta over the same period was 0.87. Wh The cost of capital using the CAPM is L196. (Round to two Data Table (Click on the icon located on the top-right comer of the data table below in order to copy its confents into a spreadsheet) Table 2: FFC Portfolio Average Monthly Returns, 1927-2015 Factor Portfolio MKT rr SMB HML PR1YR Average Monthly Return (%) 0.62 0.23 0.37 0.73 95% Confidence Band (%) 0.33 t0.19 +0.21 +0.29 Enter your answer in each of the answer boxes. Print Done You work for Microsoft Corporation (ticker: MSFT), and you are considering whether to develop a new software product. The risk of the investment is the same as the risk of the company a using the data in Table 1 shown here and Table 2 shown here. calculate the cost of capital using the FFC factor specification if the current risk-free rate is 26% per year. b. Microsoft's CAPM beta over the same period was 0.87. What cost of capital would you estimate using CAPM? a. Using the data in Table 1 and Table 2, calculate the cost of capital using the FFC factor specification if the current risk-free rate is 2.6% per year. The cost of capital using the FFC factor specification is 96 (Round to two decimal places.) b. Microsoft's CAPM beta over the same period was 0.87. What cost of capital would you estimate using CAPM? The cost of capital using the CAPM is%Round to two decimal places.) You work for Microsoft Corporation (ticker: MSFT), and you are considering whether to develop a new software product. The risk of the investment is the same as the risk of the company a. Using the data in Table 1 shown here and Table 2 shown here calculate the cost o capital using he FFC factor specification if the current risk-free rate is 2.6% per year b. Microsoft's CAPM beta over the same period was 0.87. What cost of capital would you estimate using CAPM? a. Using the data in Table 1 and Table 2, calculate the cost of capital using te FFC factor specification if the current risk-free rate is 2.6% per year. The cost of capital using the FFC factor specification is | % (Round to two decimal places ) b. Microsoft's CAPM beta over the same period was 0.87 Data Table The cost of capital using the CAPM is%Round to two (Click on the icon locafed on the fop-right comer of the data table below in order to copy its contents into a spreadsheet) Table 1: Estimated Factor Betas, 2005-2015 Factor MKT SMB HML PR1YR MSFT 1.06 -0.48 -0.13 XOM 0.78 -0.62 0.21 0.32 GE 1.29 -0.39 0.82 -0.22 Enter your answer in each of the answer boxes. Print Done You work for Microsoft Corporation (ticker: MSFT), and you are considering whether to develop a new software product. The risk of the investment is the same as the risk of the company a. Using the data in Table 1 shown here and Table 2 shown here. calculate the cost of capital using he FFC factor specification the current sk-free rate is 2.6% per year b. Microsofts CAPM beta over the same period was 0.87. What cost of capital would you estimate using CAPM? a. Using the data in Table 1 and Table 2, calculate the cost of capital using the FFC factor specification if the current risk-free rate is 2.6% per year. The cost of capital using the FFC factor specification is | %. (Round to two decimal places) b. Microsoftfs CAPM beta over the same period was 0.87. Wh The cost of capital using the CAPM is L196. (Round to two Data Table (Click on the icon located on the top-right comer of the data table below in order to copy its confents into a spreadsheet) Table 2: FFC Portfolio Average Monthly Returns, 1927-2015 Factor Portfolio MKT rr SMB HML PR1YR Average Monthly Return (%) 0.62 0.23 0.37 0.73 95% Confidence Band (%) 0.33 t0.19 +0.21 +0.29 Enter your answer in each of the answer boxes. Print Done

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts