Question: 150% declining balance method Double-declining-balance (200%) method Straight-line method Sum-of-the-years' digits method Grove Company acquired a production machine on January 1,2022 , at a cost

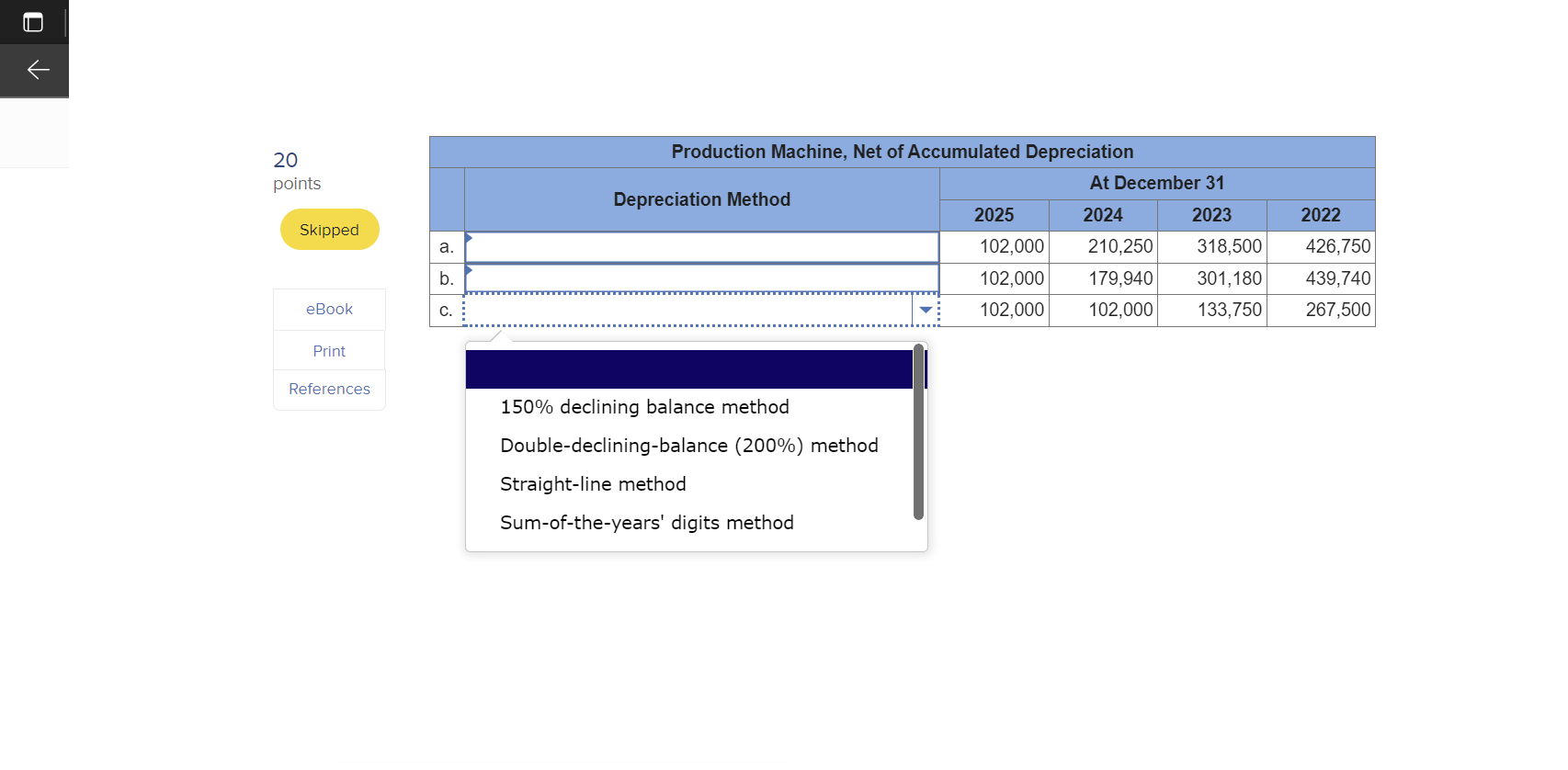

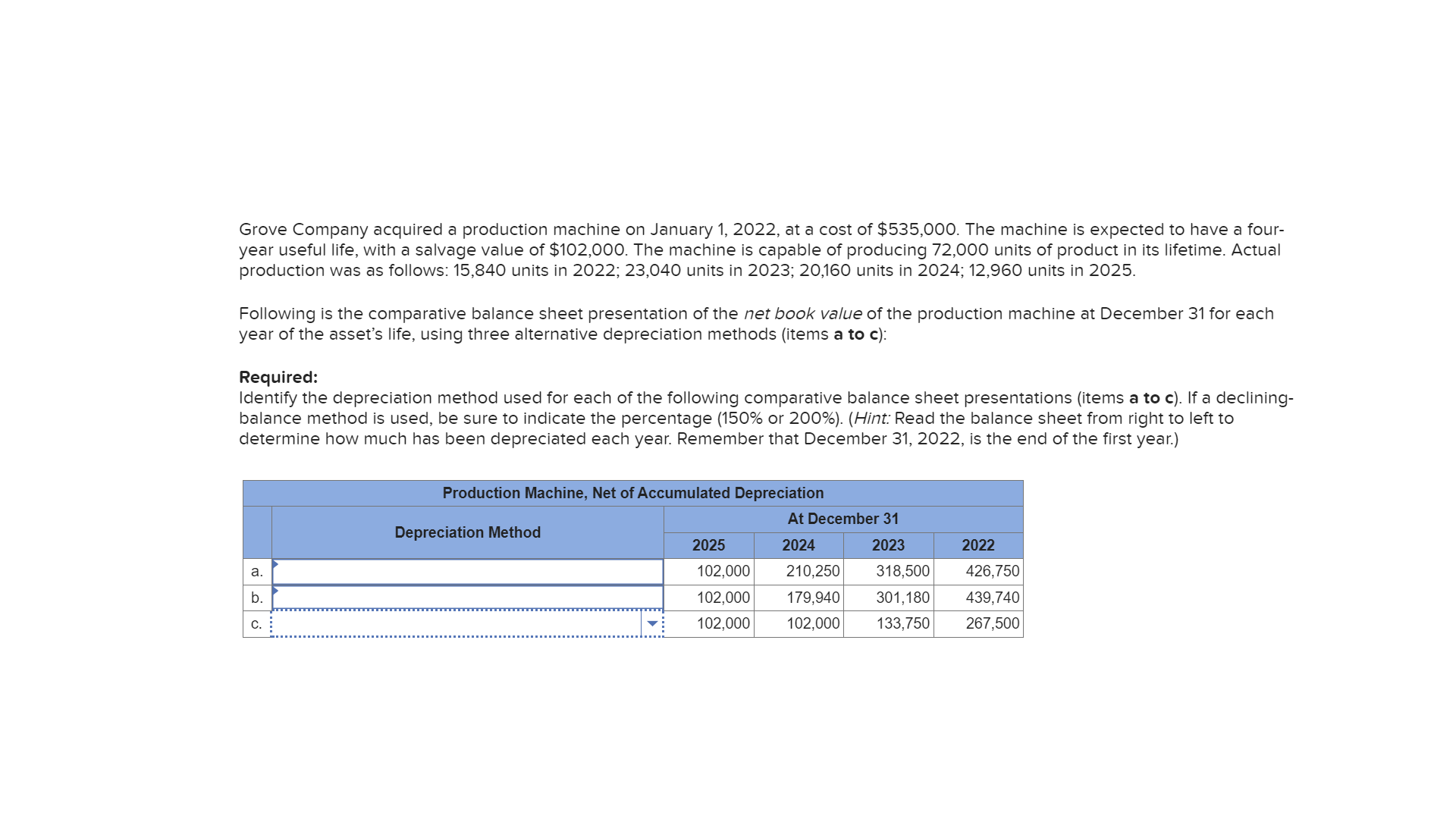

150% declining balance method Double-declining-balance (200\%) method Straight-line method Sum-of-the-years' digits method Grove Company acquired a production machine on January 1,2022 , at a cost of $535,000. The machine is expected to have a fouryear useful life, with a salvage value of $102,000. The machine is capable of producing 72,000 units of product in its lifetime. Actual production was as follows: 15,840 units in 2022; 23,040 units in 2023;20,160 units in 2024; 12,960 units in 2025. Following is the comparative balance sheet presentation of the net book value of the production machine at December 31 for each year of the asset's life, using three alternative depreciation methods (items a to c): Required: Identify the depreciation method used for each of the following comparative balance sheet presentations (items a to c). If a decliningbalance method is used, be sure to indicate the percentage ( 150% or 200% ). (Hint: Read the balance sheet from right to left to determine how much has been depreciated each year. Remember that December 31,2022 , is the end of the first year.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts