Question: = $1500 and We consider a 7-year straight term bond issued currently. It has face value F redemption value C = $1800. The annual

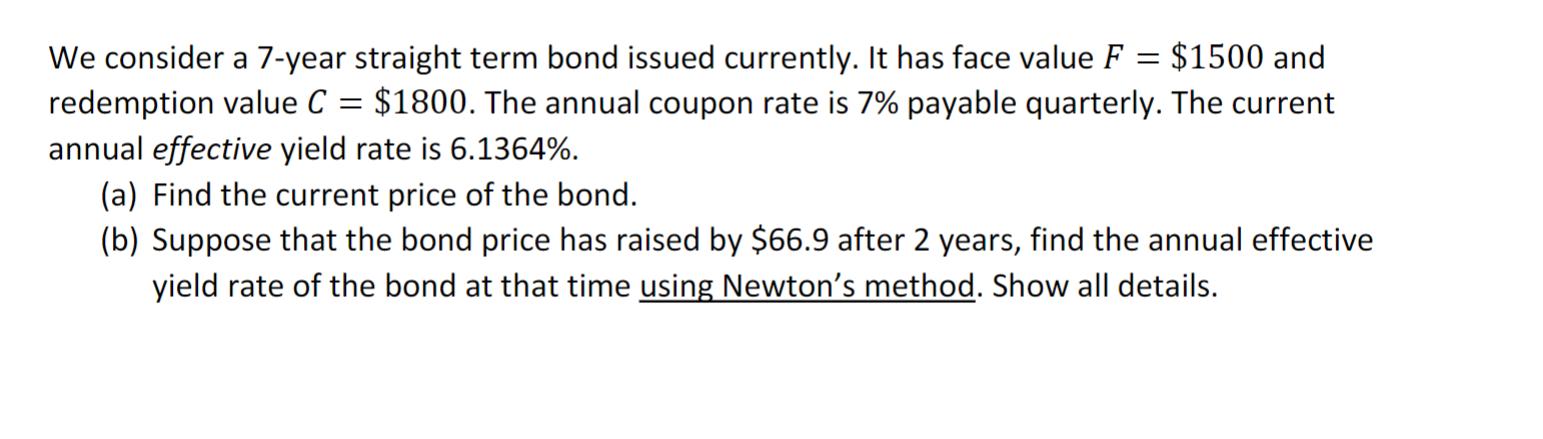

= $1500 and We consider a 7-year straight term bond issued currently. It has face value F redemption value C = $1800. The annual coupon rate is 7% payable quarterly. The current annual effective yield rate is 6.1364%. (a) Find the current price of the bond. (b) Suppose that the bond price has raised by $66.9 after 2 years, find the annual effective yield rate of the bond at that time using Newton's method. Show all details.

Step by Step Solution

3.41 Rating (145 Votes )

There are 3 Steps involved in it

We Consider 7 year straight F 1500 C 1800 Coupon ... View full answer

Get step-by-step solutions from verified subject matter experts