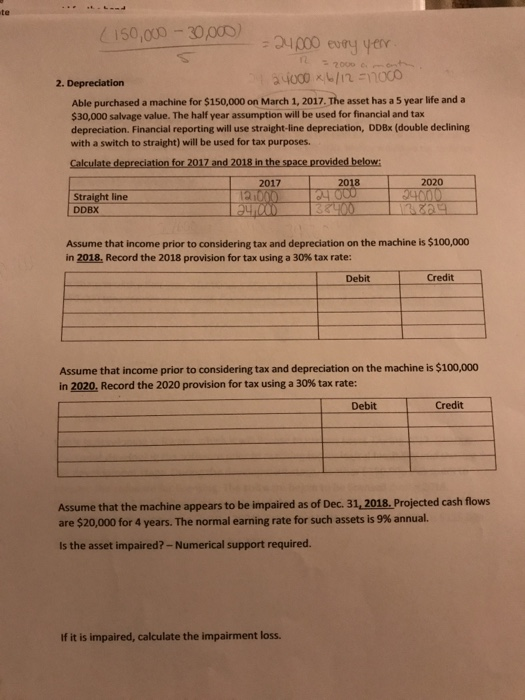

Question: (150,000 -- 30,000) = 24000 every year. 2000 - 2. Depreciation 41000x6/12 =1000 Able purchased a machine for $150,000 on March 1, 2017. The asset

(150,000 -- 30,000) = 24000 every year. 2000 - 2. Depreciation 41000x6/12 =1000 Able purchased a machine for $150,000 on March 1, 2017. The asset has a 5 year life and a $30,000 salvare value. The half year assumption will be used for financial and tax depreciation. Financial reporting will use straight-line depreciation, DDBx (double declining with a switch to straight) will be used for tax purposes. Calculate depreciation for 2017 and 2018 in the space provided below: 2017 2018 2020 Straight line 100 000 4000 DDBX 94.000 Assume that income prior to considering tax and depreciation on the machine is $100,000 in 2018, Record the 2018 provision for tax using a 30% tax rate: Debit Credit Assume that income prior to considering tax and depreciation on the machine is $100,000 in 2020, Record the 2020 provision for tax using a 30% tax rate: Debit Credit Assume that the machine appears to be impaired as of Dec. 31, 2018. Projected cash flows are $20,000 for 4 years. The normal earning rate for such assets is 9% annual Is the asset impaired? - Numerical support required. if it is impaired, calculate the impairment loss

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts