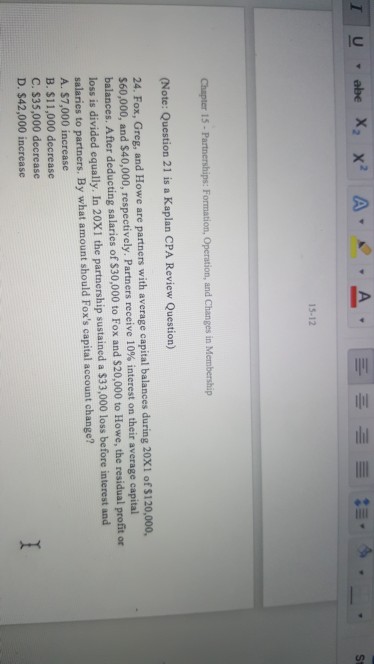

Question: 15-12 Formation, Operation, and Changes in Membership (Note: Question 21 is a Kaplan CPA Review Question) 24. Fox, Greg, and Howe are partners with average

15-12 Formation, Operation, and Changes in Membership (Note: Question 21 is a Kaplan CPA Review Question) 24. Fox, Greg, and Howe are partners with average capital balances during 20X1 of $120,000, s60,000, and $40,000, respectively. Partners receive 10% interest balances. After deducting salaries of $30,000 to Fox and $20,000 to Howe, the residual profit or loss is divided equally. In 20X1 the partnership sustained a $33,000 loss before interest and salaries to partners. By what amount should Fox's capital account change? A. $7,000 increase B. S11,000 decrease C. $35,000 decrease D. $42,000 increase on their average capital

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts