Question: 15-17) A colleague of yours knows that you have taken BUS-123, Introduction to Investments. He asks you for your opinion about an advertisement he saw

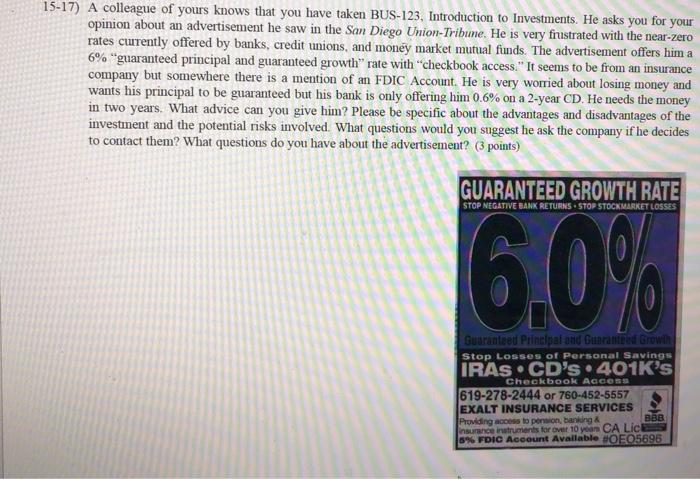

15-17) A colleague of yours knows that you have taken BUS-123, Introduction to Investments. He asks you for your opinion about an advertisement he saw in the San Diego Union-Tribune. He is very frustrated with the near-zero rates curently offered by banks, credit unions, and money market mutual funds. The advertisement offers him a 6% "guaranteed principal and guaranteed growth rate with "checkbook access." It seems to be from an insurance company but somewhere there is a mention of an FDIC Account. He is very worried about losing money and wants his principal to be guaranteed but his bank is only offering him 0.6% on a 2-year CD. He needs the money in two years. What advice can you give him? Please be specific about the advantages and disadvantages of the investment and the potential risks involved. What questions would you suggest he ask the company if he decides to contact them? What questions do you have about the advertisement? (3 points) GUARANTEED GROWTH RATE STOP NEGATIVE BANK RETURNS. STOP STOCKMARKET LOSSES 6.0% Guaranteed Principal and Guaranteed Growth Stop Losses of Personal Savings IRAS.CD's. 401K's Checkbook ACCESS 619-278-2444 or 760-452-5557 EXALT INSURANCE SERVICES Providing access to perion banking & BBB Insurance instruments for over 10 yoon CA Lic 8% FDIC Account Available #OF05696

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts