Question: 16. A bond with 5 years remaining until maturity is currently trading for 102 per 100 of par value. The bond offers a 6% coupon

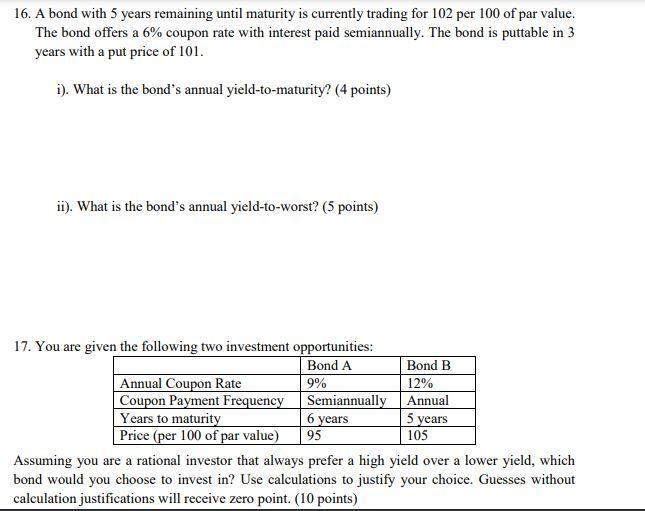

16. A bond with 5 years remaining until maturity is currently trading for 102 per 100 of par value. The bond offers a 6% coupon rate with interest paid semiannually. The bond is puttable in 3 years with a put price of 101. 1). What is the bond's annual yield-to-maturity? (4 points) ii). What is the bond's annual yield-to-worst? (5 points) 17. You are given the following two investment opportunities: Bond A Bond B Annual Coupon Rate 9% 12% Coupon Payment Frequency Semiannually Annual Years to maturity 6 years 5 years Price (per 100 of par value) 95 105 Assuming you are a rational investor that always prefer a high yield over a lower yield, which bond would you choose to invest in? Use calculations to justify your choice. Guesses without calculation justifications will receive zero point. (10 points) 16. A bond with 5 years remaining until maturity is currently trading for 102 per 100 of par value. The bond offers a 6% coupon rate with interest paid semiannually. The bond is puttable in 3 years with a put price of 101. 1). What is the bond's annual yield-to-maturity? (4 points) ii). What is the bond's annual yield-to-worst? (5 points) 17. You are given the following two investment opportunities: Bond A Bond B Annual Coupon Rate 9% 12% Coupon Payment Frequency Semiannually Annual Years to maturity 6 years 5 years Price (per 100 of par value) 95 105 Assuming you are a rational investor that always prefer a high yield over a lower yield, which bond would you choose to invest in? Use calculations to justify your choice. Guesses without calculation justifications will receive zero point. (10 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts