Question: 16) A) Given the cash flow timeline presented previously, what price should you pay today in order to earn 30% per year over the life

16) A) Given the cash flow timeline presented previously, what price should you pay today in order to earn 30% per year over the life of the investment?

B) What price should you pay today in order to earn 7% per year over the life of the investment?

C) What price should you pay today in order to LOSE 10% per year over the life of the investment?

D) What price should you pay today in order to earn 15% per year for the first 3 years, and then earn 8% per year thereafter?

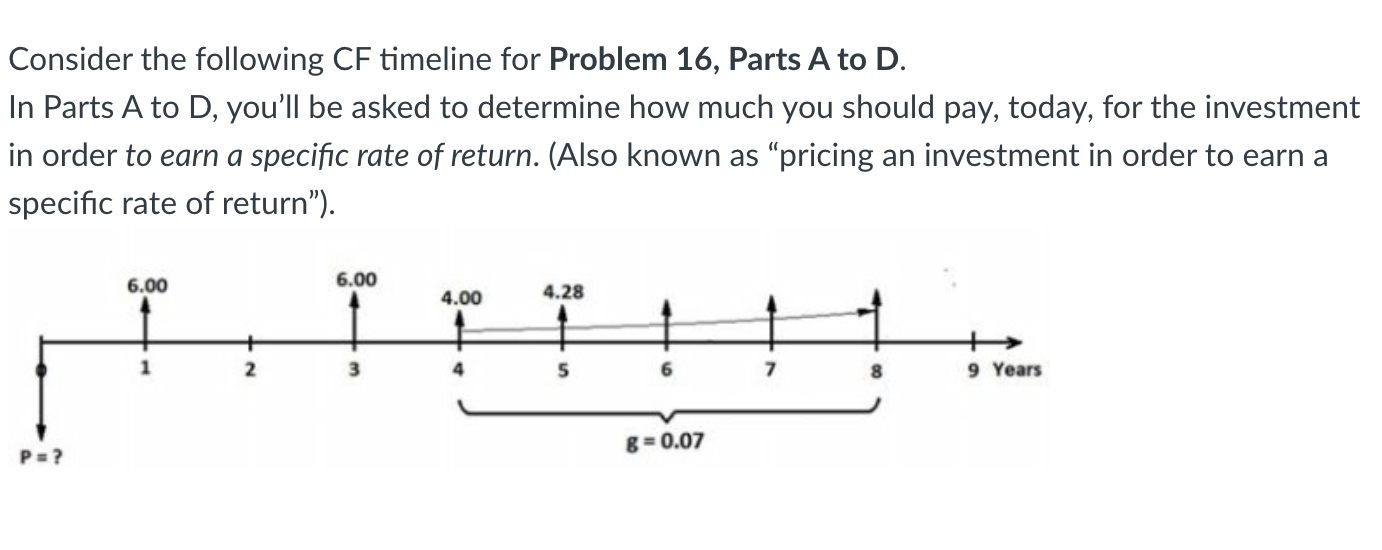

Consider the following CF timeline for Problem 16, Parts A to D. In Parts A to D, you'll be asked to determine how much you should pay, today, for the investment in order to earn a specific rate of return. (Also known as pricing an investment in order to earn a specific rate of return"). 6.00 6.00 4.00 4.28 9 Years 8=0.07 Consider the following CF timeline for Problem 16, Parts A to D. In Parts A to D, you'll be asked to determine how much you should pay, today, for the investment in order to earn a specific rate of return. (Also known as pricing an investment in order to earn a specific rate of return"). 6.00 6.00 4.00 4.28 9 Years 8=0.07

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts