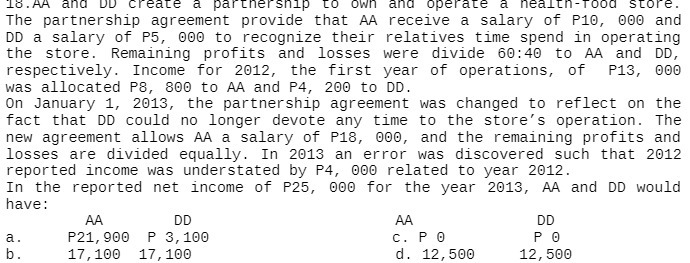

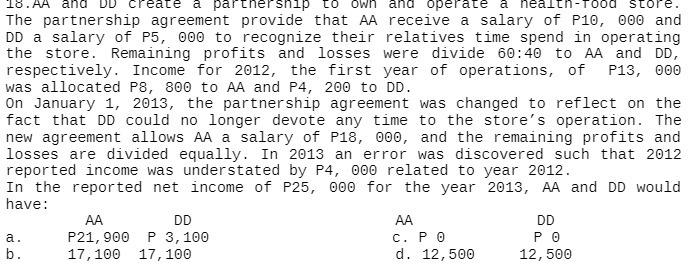

Question: 16 . AA and DD create a partnership to own and operate a health-food store. The partnership agreement provide that AA receive a salary of

16 . AA and DD create a partnership to own and operate a health-food store. The partnership agreement provide that AA receive a salary of P10, 000 and DD a salary of P5, 000 to recognize their relatives time spend in operating the store. Remaining profits and losses were divide 60:40 to AA and DD, respectively. Income for 2012, the first year of operations, of P13, 000 was allocated PS, 800 to AA and P4, 200 to DD. On January 1, 2013, the partnership agreement was changed to reflect on the fact that DD could no longer devote any time to the store's operation. The new agreement allows AA a salary of P18, 000, and the remaining profits and losses are divided equally. In 2013 an error was discovered such that 2012 reported income was understated by P4, 000 related to year 2012. In the reported net income of P25, 000 for the year 2013, AA and DD would have : AA DD AA DD a . P21, 900 P 3, 100 C. PO b . 17, 100 17 , 100 d. 12, 500 12, 500

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts