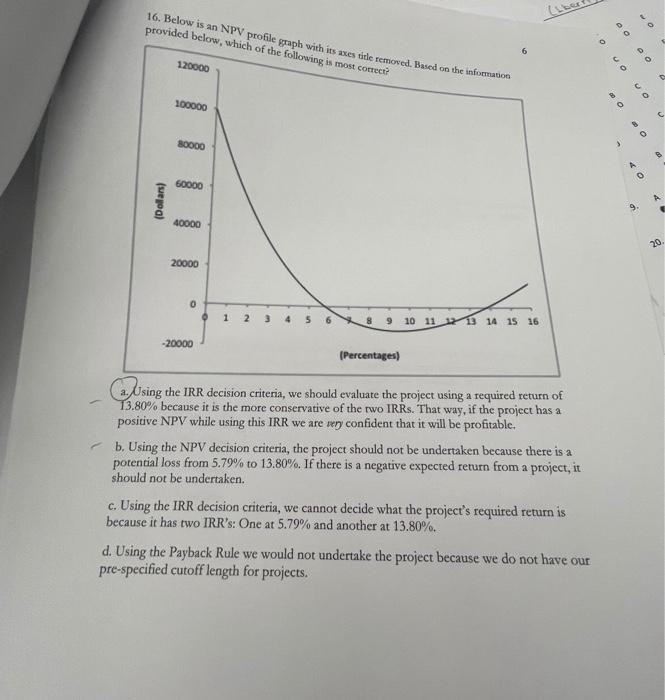

Question: 16. Below is an NPV profile graph with its axes title removed. Based on the information provided below, which of the following is most correct?

16. Below is an NPV profile graph with its axes title removed. Based on the information provided below, which of the following is most correct? 6 D O 120000 0 O 100000 o O 80000 3 60000 Dollars) . 40000 20 20000 0 . 1 8 9 10 11 12 13 14 15 16 -20000 (Percentages) a. using the IRR decision criteria, we should evaluate the project using a required return of 13.80% because it is the more conservative of the two IRRs. That way, if the project has a positive NPV while using this IRR we are very confident that it will be profitable. b. Using the NPV decision criteria, the project should not be undertaken because there is a potential loss from 5.79% to 13.80%. If there is a negative expected return from a project, it should not be undertaken. c. Using the IRR decision criteria, we cannot decide what the project's required return is because it has two IRR's: One at 5.79% and another at 13.80%. d. Using the Payback Rule we would not undertake the project because we do not have our pre-specified cutoff length for projects

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts