Question: 16 CFP Exam Prep R. E Rods The Company's beta is 1.35 and its dividend growth rate is 10.35%, just yesterday, it paid a dividend

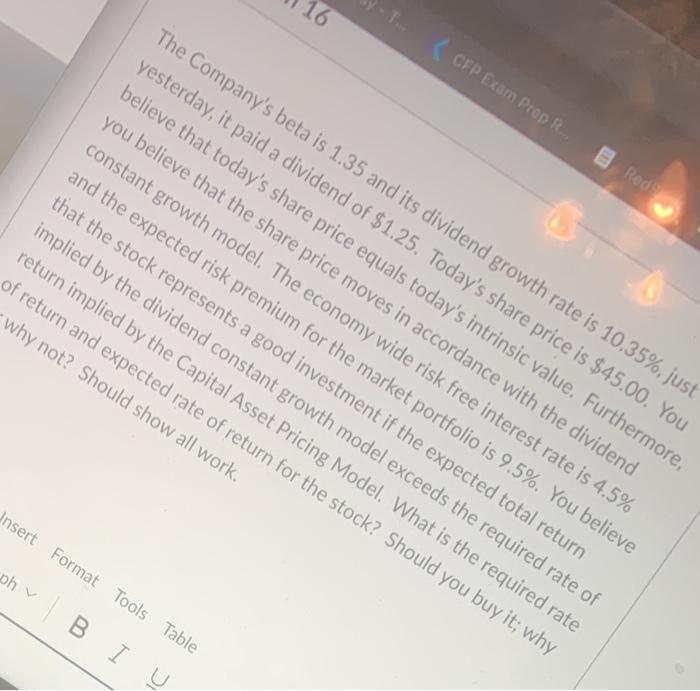

16 CFP Exam Prep R. E Rods The Company's beta is 1.35 and its dividend growth rate is 10.35%, just yesterday, it paid a dividend of $1.25. Today's share price is $45.00. You believe that today's share price equals today's intrinsic value. Furthermore, you believe that the share price moves in accordance with the dividend constant growth model. The economy wide risk free interest rate is 4.5% and the expected risk premium for the market portfolio is 9.5%. You believe that the stock represents a good investment if the expected total return implied by the dividend constant growth model exceeds the required rate of return implied by the Capital Asset Pricing Model. What is the required rate of return and expected rate of return for the stock? Should you buy it; why why not? Should show all work. Insert Format Tools Table ph

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts