Question: 16. Consider the following two-factor APT model for a security. The risk-free rate is 4. Column (1) shows the factor sensitivities. Column (2) tabulates the

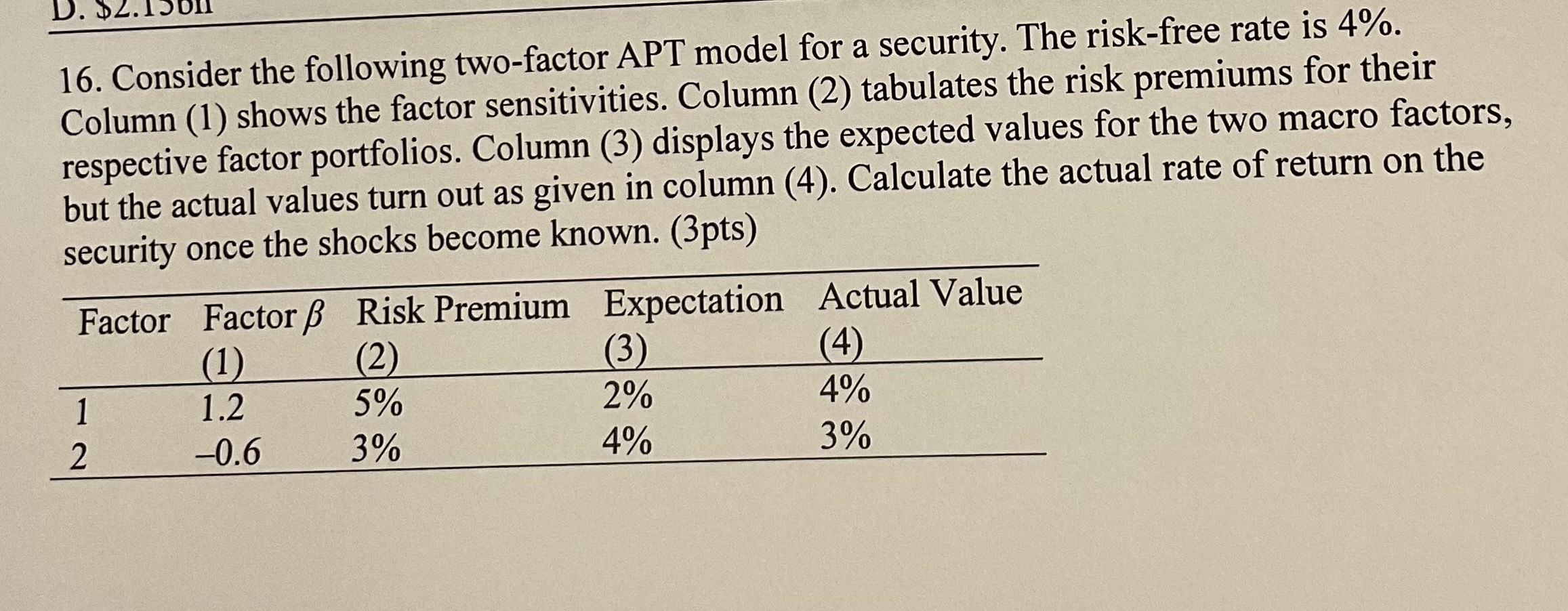

16. Consider the following two-factor APT model for a security. The risk-free rate is \4. Column (1) shows the factor sensitivities. Column (2) tabulates the risk premiums for their respective factor portfolios. Column (3) displays the expected values for the two macro factors, but the actual values turn out as given in column (4). Calculate the actual rate of return on the security once the shocks become known. (3pts)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts