Question: 16. For some reason, the market puts a higher value on firms without debt than on firms with debt, as below, even though the firms

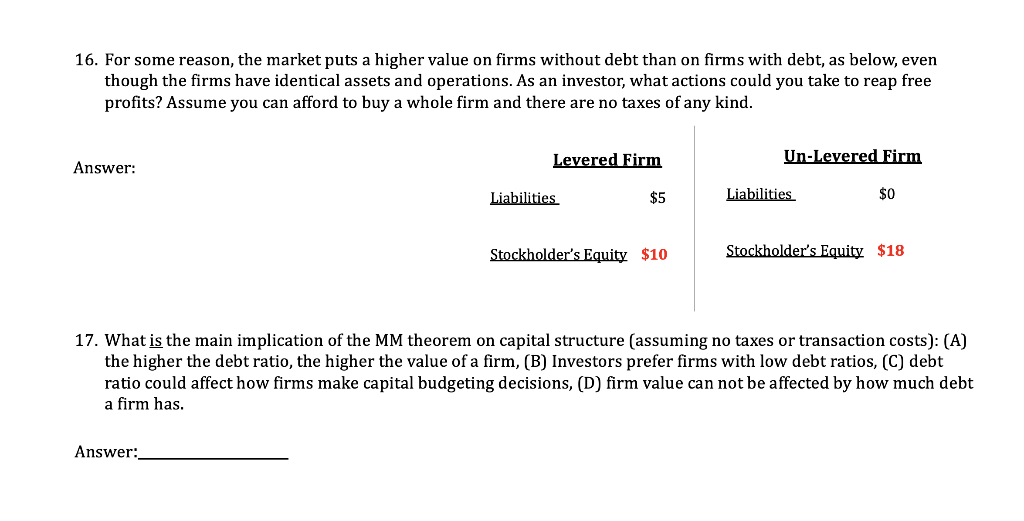

16. For some reason, the market puts a higher value on firms without debt than on firms with debt, as below, even though the firms have identical assets and operations. As an investor, what actions could you take to reap free profits? Assume you can afford to buy a whole firm and there are no taxes of any kind. Levered Firm Un-Levered Firm Answer: Liabilities $5 Liabilities $0 Stockholder's Equity $10 Stockholder's Equity $18 17. What is the main implication of the MM theorem on capital structure (assuming no taxes or transaction costs): (A) the higher the debt ratio, the higher the value of a firm, (B) Investors prefer firms with low debt ratios, (C) debt ratio could affect how firms make capital budgeting decisions, (D) firm value can not be affected by how much debt a firm has. Answer: 16. For some reason, the market puts a higher value on firms without debt than on firms with debt, as below, even though the firms have identical assets and operations. As an investor, what actions could you take to reap free profits? Assume you can afford to buy a whole firm and there are no taxes of any kind. Levered Firm Un-Levered Firm Answer: Liabilities $5 Liabilities $0 Stockholder's Equity $10 Stockholder's Equity $18 17. What is the main implication of the MM theorem on capital structure (assuming no taxes or transaction costs): (A) the higher the debt ratio, the higher the value of a firm, (B) Investors prefer firms with low debt ratios, (C) debt ratio could affect how firms make capital budgeting decisions, (D) firm value can not be affected by how much debt a firm has

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts