Question: -16. Future Value, Present Value, Deferred Annuity, Debt Retirement. Ne-Yo borrowed $500,000 to build a recording studio in his home. The total amount of the

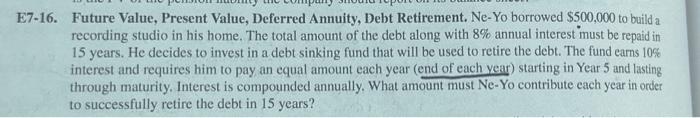

-16. Future Value, Present Value, Deferred Annuity, Debt Retirement. Ne-Yo borrowed $500,000 to build a recording studio in his home. The total amount of the debt along with 8% annual interest must be repaid in 15 years. He decides to invest in a debt sinking fund that will be used to retire the debt. The fund earns 105 interest and requires him to pay an equal amount each year (end of each vear) starting in Year 5 and lasting through maturity. Interest is compounded annually. What amount must Ne-Yo contribute each year in order to successfully retire the debt in 15 years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts