Question: 16 It is more likely than not that some or all of P&G's deferred tax asset will not be realized. Is this statement true or

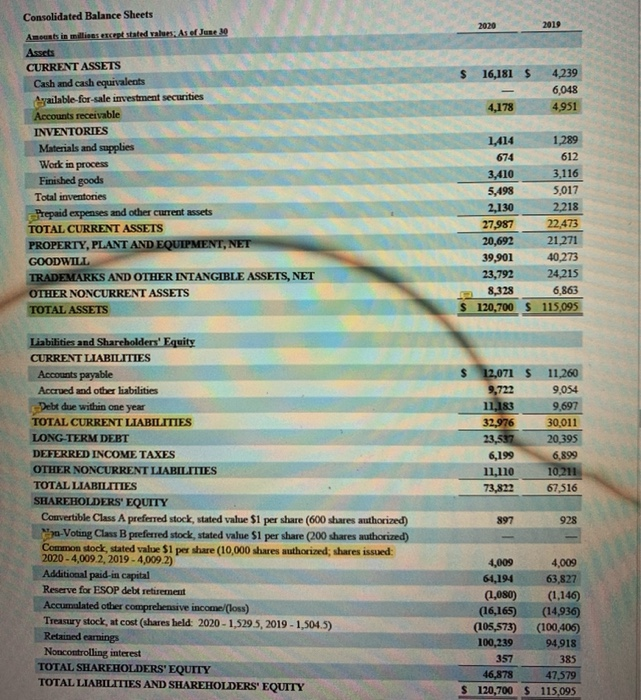

16 It is more likely than not that some or all of P&G's deferred tax asset will not be realized. Is this statement true or false for P&G? How do we know this? IF 2020 2019 $ 16,181 $ 4,239 6,048 4,951 4,178 Consolidated Balance Sheets Aments in milies except stated values. As of June 10 Assets CURRENT ASSETS Cash and cash equivalents Oyailable for sale investment securities Accounts receivable INVENTORIES Materials and supplies Work in process Finished goods Total inventories Prepaid expenses and other current assets TOTAL CURRENT ASSETS PROPERTY, PLANT AND EQUIPMENT, NET GOODWILL TRADEMARKS AND OTHER INTANGIBLE ASSETS, NET OTHER NONCURRENT ASSETS TOTAL ASSETS 1.414 1,289 674 612 3,410 3,116 5,498 5,017 2,130 2,218 27,987 22,473 20,692 21,271 39,901 40,273 23,792 24.215 8,328 6,863 $ 120,700 $ 115,095 12,071 S 9,722 11,183 32,976 23,537 6,199 11,110 73,822 11,260 9,054 9,697 30.011 20,395 6,899 10,211 67,516 Liabilities and Shareholders' Equity CURRENT LIABILITIES Accounts payable Accrued and other liabilities Debt due within one year TOTAL CURRENT LIABILITIES LONG-TERM DEBT DEFERRED INCOME TAXES OTHER NONCURRENT LIABILITIES TOTAL LIABILITIES SHAREHOLDERS' EQUITY Convertible Class A preferred stock, stated value $1 per share (600 shares authorized) F-Voting Class B preferred stock, stated value S1 per share (200 shares authorized) Common stock, stated value $1 per share (10,000 shares authorized; shares issued: 2020 - 4,009 2, 2019 - 4,009.2) Additional paid-in capital Reserve for ESOP debt retirement Accumulated other comprehensive income (loss) Treasury stock, at cost shares held: 2020 - 1,5295, 2019 - 1,504.5) Retained earning Noncontrolling interest TOTAL SHAREHOLDERS' EQUITY TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY 897 928 4,009 4,009 61,194 63,827 (1,080) (1.146) (16,165) (14,936) (105,573) (100,406) 100,239 94,918 357 385 46,878 47,579 $ 120,700 $ 115,095

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts