Question: 16. (Lecture Note 4) The current time is September 28. You are managing a bond portfolio worth $250 million for PIMCO Asset Management in California.

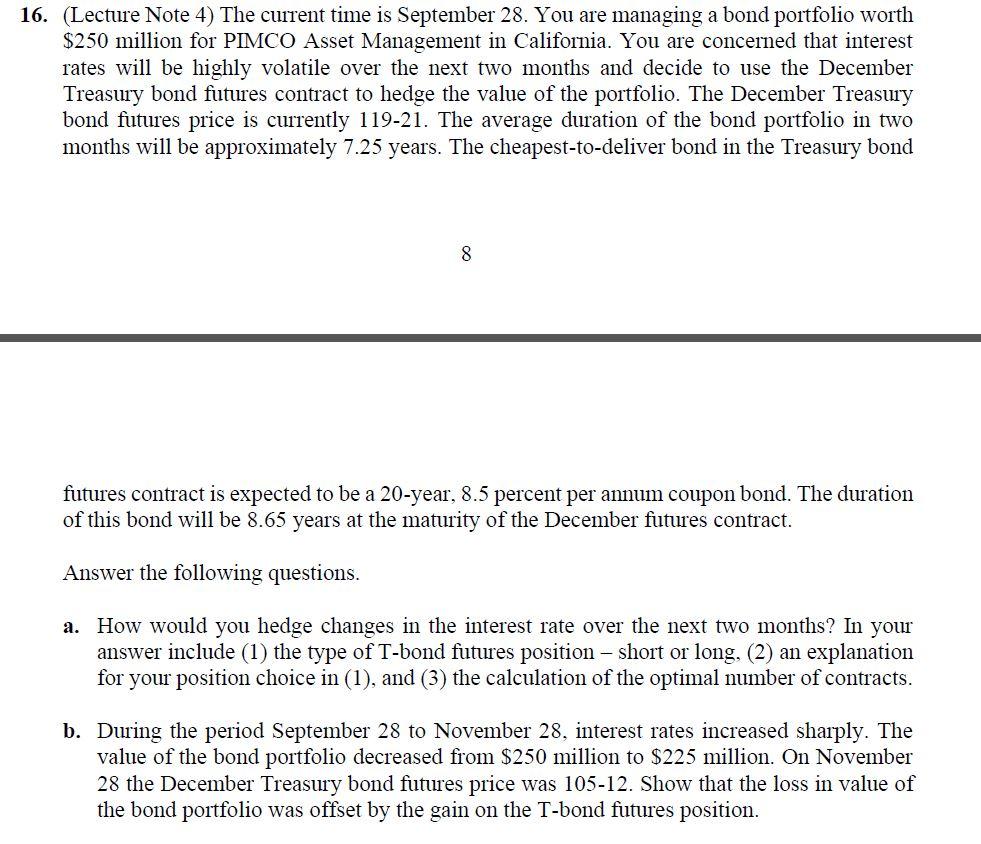

16. (Lecture Note 4) The current time is September 28. You are managing a bond portfolio worth $250 million for PIMCO Asset Management in California. You are concerned that interest rates will be highly volatile over the next two months and decide to use the December Treasury bond futures contract to hedge the value of the portfolio. The December Treasury bond futures price is currently 119-21. The average duration of the bond portfolio in two months will be approximately 7.25 years. The cheapest-to-deliver bond in the Treasury bond 8 futures contract is expected to be a 20-year, 8.5 percent per annum coupon bond. The duration of this bond will be 8.65 years at the maturity of the December futures contract. Answer the following questions. a. How would you hedge changes in the interest rate over the next two months? In your answer include (1) the type of T-bond futures position short or long, (2) an explanation for your position choice in (1), and (3) the calculation of the optimal number of contracts. b. During the period September 28 to November 28, interest rates increased sharply. The value of the bond portfolio decreased from $250 million to $225 million. On November 28 the December Treasury bond futures price was 105-12. Show that the loss in value of the bond portfolio was offset by the gain on the T-bond futures position. 16. (Lecture Note 4) The current time is September 28. You are managing a bond portfolio worth $250 million for PIMCO Asset Management in California. You are concerned that interest rates will be highly volatile over the next two months and decide to use the December Treasury bond futures contract to hedge the value of the portfolio. The December Treasury bond futures price is currently 119-21. The average duration of the bond portfolio in two months will be approximately 7.25 years. The cheapest-to-deliver bond in the Treasury bond 8 futures contract is expected to be a 20-year, 8.5 percent per annum coupon bond. The duration of this bond will be 8.65 years at the maturity of the December futures contract. Answer the following questions. a. How would you hedge changes in the interest rate over the next two months? In your answer include (1) the type of T-bond futures position short or long, (2) an explanation for your position choice in (1), and (3) the calculation of the optimal number of contracts. b. During the period September 28 to November 28, interest rates increased sharply. The value of the bond portfolio decreased from $250 million to $225 million. On November 28 the December Treasury bond futures price was 105-12. Show that the loss in value of the bond portfolio was offset by the gain on the T-bond futures position

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts