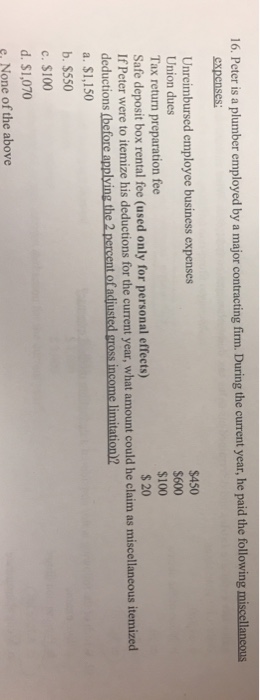

Question: 16. Peter is a plumber employed by a major contracting firm. During the current year, he paid the following miscellancous expenses $450 $600 $100 s

16. Peter is a plumber employed by a major contracting firm. During the current year, he paid the following miscellancous expenses $450 $600 $100 s 20 Unreimbursed employee business expenses Union dues Tax return preparation fee Safe deposit box rental fee (used only for personal effects) If Peter were to itemize his deductions deductions (before applying the 2 percent of adjusted gross income limitation)2 a. $1,150 b. $550 c. $100 d. $1,070 e. None of the above for the current year, what amount could he claim as miscellaneous itemized

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts