Question: 16 Please answer the questions in one Excel file. Name your file: Project_FirstNamel FirstName2 FirstName3 FirstName4. Please send the file to: liping.qiu@uconn.edu. Choose a call

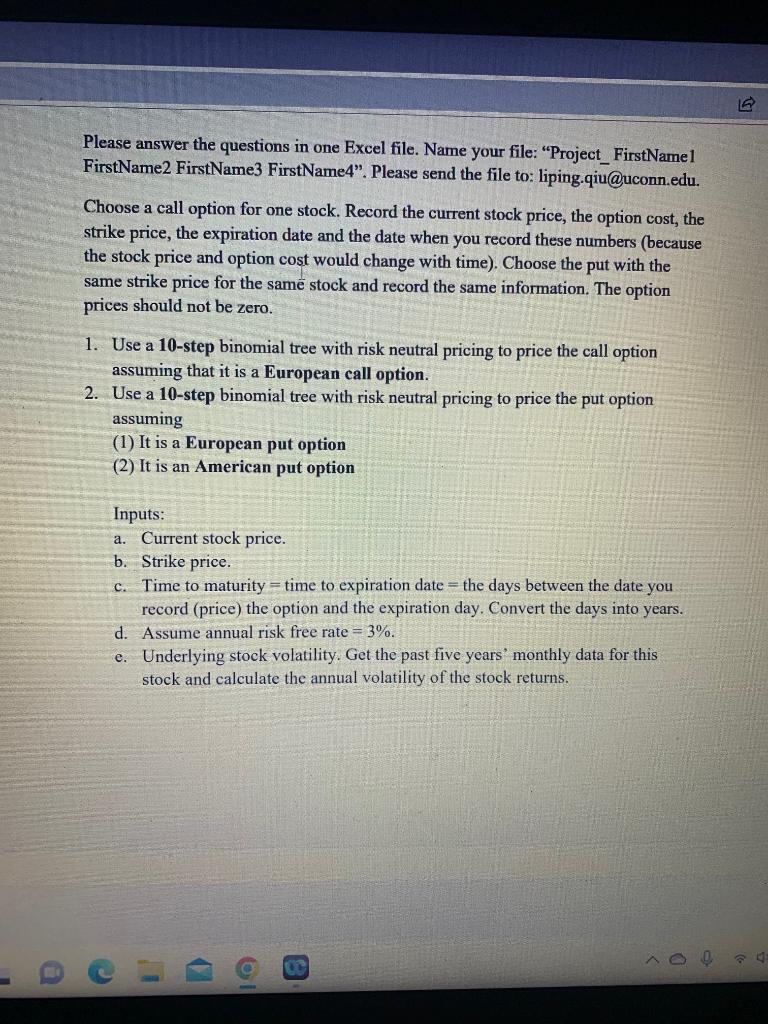

16 Please answer the questions in one Excel file. Name your file: "Project_FirstNamel FirstName2 FirstName3 FirstName4". Please send the file to: liping.qiu@uconn.edu. Choose a call option for one stock. Record the current stock price, the option cost, the strike price, the expiration date and the date when you record these numbers (because the stock price and option cost would change with time). Choose the put with the same strike price for the same stock and record the same information. The option prices should not be zero. 1. Use a 10-step binomial tree with risk neutral pricing to price the call option assuming that it is a European call option. 2. Use a 10-step binomial tree with risk neutral pricing to price the put option assuming (1) It is a European put option (2) It is an American put option Inputs: a. Current stock price. b. Strike price. c. Time to maturity = time to expiration date = the days between the date you. record (price) the option and the expiration day. Convert the days into years. d. Assume annual risk free rate = 3%. e. Underlying stock volatility. Get the past five years' monthly data for this stock and calculate the annual volatility of the stock returns. 8 C 16 Please answer the questions in one Excel file. Name your file: "Project_FirstNamel FirstName2 FirstName3 FirstName4". Please send the file to: liping.qiu@uconn.edu. Choose a call option for one stock. Record the current stock price, the option cost, the strike price, the expiration date and the date when you record these numbers (because the stock price and option cost would change with time). Choose the put with the same strike price for the same stock and record the same information. The option prices should not be zero. 1. Use a 10-step binomial tree with risk neutral pricing to price the call option assuming that it is a European call option. 2. Use a 10-step binomial tree with risk neutral pricing to price the put option assuming (1) It is a European put option (2) It is an American put option Inputs: a. Current stock price. b. Strike price. c. Time to maturity = time to expiration date = the days between the date you. record (price) the option and the expiration day. Convert the days into years. d. Assume annual risk free rate = 3%. e. Underlying stock volatility. Get the past five years' monthly data for this stock and calculate the annual volatility of the stock returns. 8 C

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts