Question: 16 points 5. Given the following balance sheet data on a Financial Institution, namely Canada Trust ASSETS LIABILITIES/NET WORTH Liabilities $525 million $650 million Net

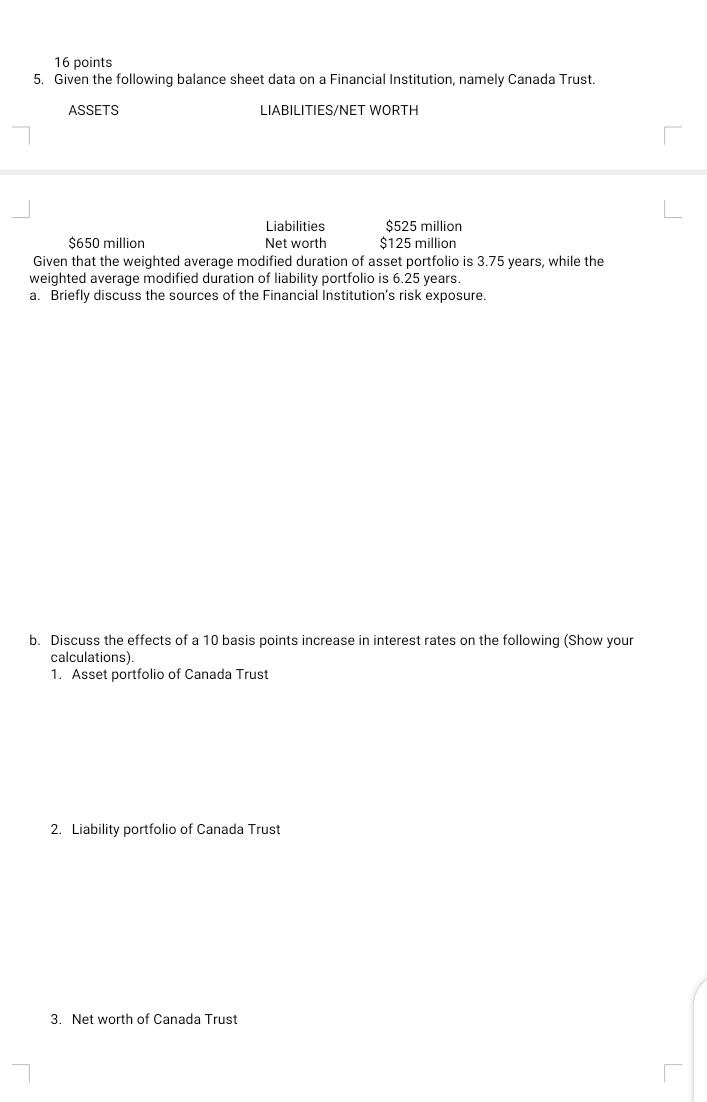

16 points 5. Given the following balance sheet data on a Financial Institution, namely Canada Trust ASSETS LIABILITIES/NET WORTH Liabilities $525 million $650 million Net worth $125 million Given that the weighted average modified duration of asset portfolio is 3.75 years, while the weighted average modified duration of liability portfolio is 6.25 years. a. Briefly discuss the sources of the Financial Institution's risk exposure. b. Discuss the effects of a 10 basis points increase in interest rates on the following (Show your calculations) 1. Asset portfolio of Canada Trust 2. Liability portfolio of Canada Trust 3. Net worth of Canada Trust 16 points 5. Given the following balance sheet data on a Financial Institution, namely Canada Trust ASSETS LIABILITIES/NET WORTH Liabilities $525 million $650 million Net worth $125 million Given that the weighted average modified duration of asset portfolio is 3.75 years, while the weighted average modified duration of liability portfolio is 6.25 years. a. Briefly discuss the sources of the Financial Institution's risk exposure. b. Discuss the effects of a 10 basis points increase in interest rates on the following (Show your calculations) 1. Asset portfolio of Canada Trust 2. Liability portfolio of Canada Trust 3. Net worth of Canada Trust

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts