Question: (16 points) Exercise C5a (Internal service settlement/ Cost centre accounting) Controlling department provides information of costs (June 2021) caused in two direct cost centres (Production

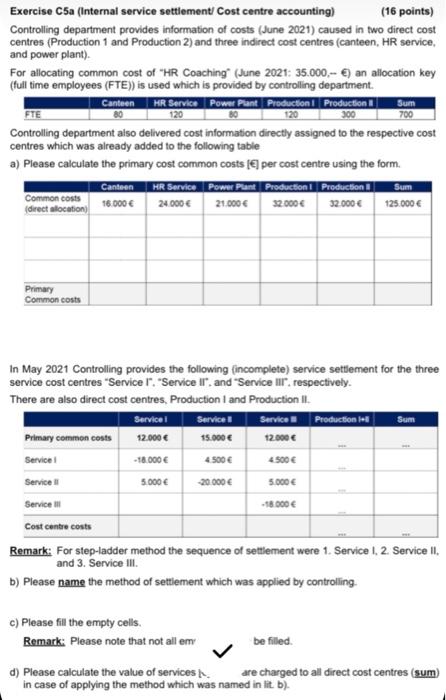

Exercise C5a (Internal service settiement/ Cost centre accounting) (16 points) Controlling department provides information of costs (June 2021) caused in two direct cost centres (Production 1 and Production 2) and three indirect cost centres (canteen, HR service, and power plant). For allocating common cost of "HR Coaching" (June 2021: 35.000,- ) an allocation key (full time employees (FTE)) is used which is provided by controlling department. Controlling department also delivered cost information directly assigned to the respective cost centres which was already added to the following table a) Please calculate the primary cost common costs [] per cost centre using the form. In May 2021 Controlling provides the following (incomplete) service settement for the three service cost centres "Service Ir, "Service II, and 'Service III, respectively. There are also direct cost centres, Production I and Production II. Remark: For step-ladder method the sequence of settlement were 1. Service 1, 2. Service II, and 3. Service III. b) Please name the method of settiement which was applied by controlling. c) Please fill the empty cells. Remark: Please note that not all em be filled. d) Please calculate the value of services h. are charged to all direct cost centres (sum) in case of applying the method which was named in itit b)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts