Question: (16 points) Ruby Corp. bonds, which have a 3% coupon rate, just paid their annual coupon. They mature in 5 years. The price of the

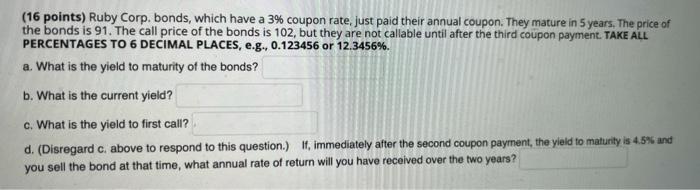

(16 points) Ruby Corp. bonds, which have a 3% coupon rate, just paid their annual coupon. They mature in 5 years. The price of the bonds is 91. The call price of the bonds is 102, but they are not callable until after the third coupon payment. TAKE ALL PERCENTAGES TO 6 DECIMAL PLACES, e.g., 0.123456 or 12.3456%. a. What is the yield to maturity of the bonds? b. What is the current yield? c. What is the yield to first call? d. (Disregard c. above to respond to this question.) If, immediately after the second coupon payment, the yield to maturity is 4.5% and you sell the bond at that time, what annual rate of return will you have received over the two years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts